Rushmoor Borough Council has produced a draft Employment Land Review (ELR) on behalf of Hart District Council, Surrey Heath and Rushmoor. We Heart Hart has examined this draft document and found some serious errors in the way they have calculated both the historic jobs growth numbers and the future jobs projections for the area. Moreover, after discounting the Experian methodology for calculating future jobs growth saying:

“Experian-derived forecasts which are considered unreliably high in that they make too many assumptions around unconstrained economic growth”,

they recommend that the scenario that is used for testing should be based on the numbers for housing development contained in the SHMA, which themselves are inflated by the self same Experian forecasts they earlier dismissed as unreliable. This is clearly an absurd position that results in the forward B-class job projections (598 per annum) being nearly double the rate (300 per annum) that would be achieved if we continued at the rate of growth that was delivered between 1998 and 2012. The impact of this is that the amount of employment land we need is being over-stated and so reducing the amount of brownfield land that might be available for housing. This represents a great opportunity for Hart Council to challenge Rushmoor to re-visit the ELR and revise it so that more brownfield land comes available across the three districts.

We have asked several questions about the errors we found, but have not received satisfactory responses. We urge you to contact your councillors and ask them to challenge Rushmoor to come up with more realistic estimates and revise the ELR before it becomes final and sign our petition:

The detail of the analysis is shown below.

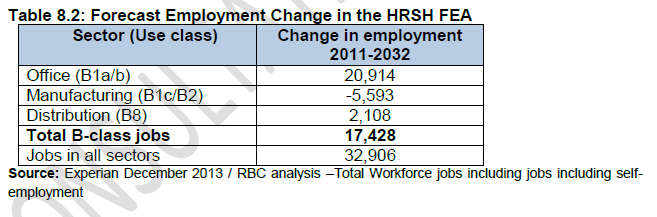

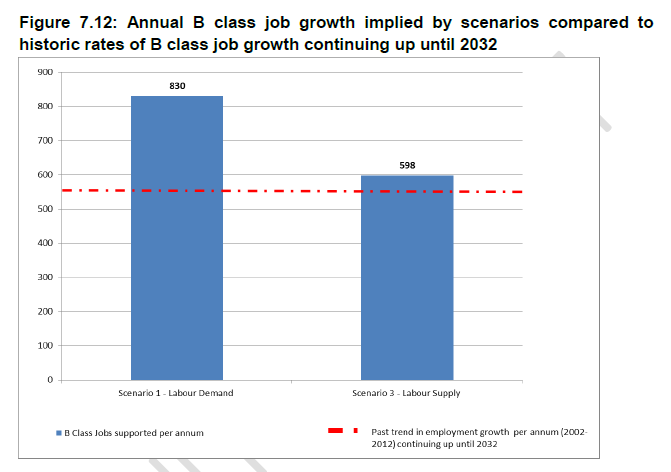

The starting point for the analysis is Table 8.2 that shows the forecast employment change in a number of different types of jobs, from which it is possible to derive the ratio of B-Class jobs to all jobs at 53% (17,428/32,906). B-Class jobs means those jobs that require office space or light industrial units, rather than an indication that they are somehow inferior. Then we must look at Figure 7.12 that allegedly compares the historic rate of growth of B-Class jobs to the forward projections.

By inspection, Figure 7.12 shows the trend in B-Class jobs as approx 555 per annum from 2002-2012. The data from Table 8.2 allows us to derive total job growth of around 1,048 per annum. However, as we shall show below, this number is far in excess of the actual job growth achieved according to the SHMA.

The SHMA contains data on the historic rates of job growth. This shows two sets of data that are derived from different sources and cover different time periods (Figures 4.3 & 4.4 of the SHMA).

First, there is the period 1998-2008, covered by ABI data. This shows overall job growth in the period of 7,200, or 720 per annum for the 10 year period with a compound annual growth rate (CAGR) of 0.6%. This would equate to a growth rate of B-Class jobs of 382 per annum, far lower than the 555 jobs per annum shown in figure 7.12.

Second there are different BRES sourced data for the periods of 2009-2012. The BRES data from 2009-2012 shows total jobs growth of 200, or 67 per annum (35 B-Class per annum) for the 3 years in question or a CAGR of 0.05%, again far lower than the 555 in figure 7.12. It is difficult to see how the 555 number was derived since it is much higher than either period covered in the SHMA. Despite repeated questions, no one has been able to explain how they derived their number for Figure 7.12.

Comparison of the BRES data and the ABI data shows a discontinuity between 2008 and 2009, with a jobs increase of nearly 10,000 when we know the economy was in the teeth of a deep recession. Note that the report states that the ABI and BRES data cannot be directly compared because they are compiled using different methods. It is therefore clear that each period (and dataset) should be treated separately and independently rather than splicing them together.

Treating the datasets separately would indicate total jobs growth over the economic cycle of 7,400, or 529 per annum or a CAGR of 0.41%, based on backward extrapolation of the BRES data. This would equate to B-Class jobs growth rate of 280 per annum, or about half the number in Figure 7.12 of the ELR.

Taking the 0.41% rate of growth as a future projection would mean we would add 11,332 overall jobs over the period of 2012-2032 at an average rate of 567 total jobs per annum, or 300 B-Class jobs per annum.

However, the scenario recommended for testing in the ELR assumes a rate of B-Class jobs growth of 598 per annum (or total jobs growth of 1,128 per annum), nearly double the rate that would represent a forward projection of past performance over the economic cycle. Incidentally, this is almost the same number as the future jobs growth number contained in the SHMA, which is based on the same Experian forecasts that the ELR itself discredits.