We have done more digging into the plans to replace the Harlington in Fleet by building a new facility on Gurkha Square. We have uncovered the Harlington Horror Show. We believe these plans represent a massive destruction of value for taxpayers.

- Hart taxpayers lose around £140K per year, and lose at least £1.2m of value in Gurkha Square. They might get some of the Views in return, but have to fork out maybe up to £500K to replace the lost parking spaces.

- Fleet taxpayers gain Gurkha Square and a brand new

£9.9m£11m building, that will cost them at least£26.6m£34.3m over a4558 year repayment period and they lose part of The Views. They might also gain parking revenue from the remaining car park. ***Stop Press: Costs now escalated to £11m*** - Everybody gains another decaying building in the form of the old Harlington blighting the town centre for years into the future, with no plan and no money to do anything about it

- There are no plans for the much needed wider regeneration of Fleet, and there are no plans to raise any private money to back the scheme.

It is difficult to see how these arrangements pass any sensible application of Government Value for Money principles. This is truly the Harlington Horror Show.

If you want to do something about this, please respond to the petition that can be found here.

Please also object to the planning application here (or search for application 18/00147/OUT on https://publicaccess.hart.gov.uk/ )

Here is detail of the facts as we understand them, that have led us to the conclusions:

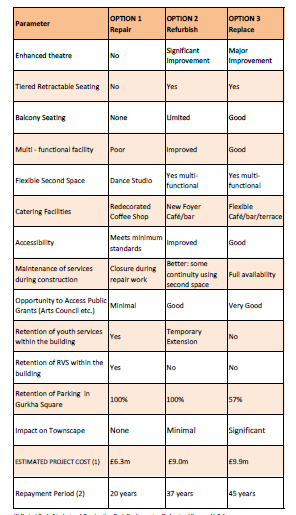

The Harlington Centre Consultation

In 2017, Fleet Town Council (FTC) consulted on 3 options for the Harlington Fleet. The options were Repair, Refurbish, or Replace. The Replace option mean building a new facility on Gurkha Square car park. Of the 1,481 people who responded to the survey, 86% or 1,274 were Fleet residents. Of those Fleet residents, 53% or 675 people chose the ‘Replace’ option. FTC has taken this as a mandate to spend approximately £10 million to be raised from Fleet Council Tax payers.

The main issue with the consultation is that at the time, FTC did not even have a lease to operate within the existing Harlington and nor does it own the Gurkha Square car park. So, it held a consultation about two options that were not within its gift to deliver. It might as well have had a consultation about how many fairies we would like at the bottom of the garden.

Current position of the Harlington, Fleet

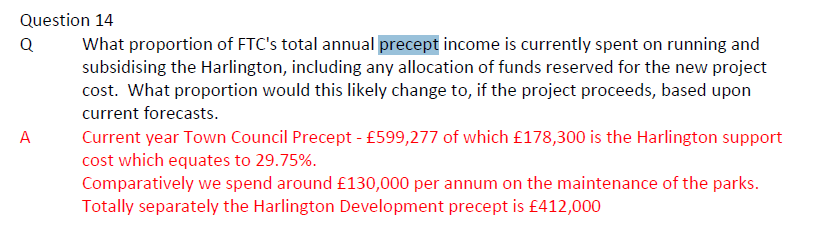

Currently the Harlington generates an operating loss of around £180,000 per year and this is expected to continue with the new facility.

It was resolved earlier this year that the Joint Chief Executive in consultation with the Portfolio Holder for Services be authorised to enter into an interim short term ‘two year rolling’ lease for the Harlington with FTC. We don’t know the details of that lease.

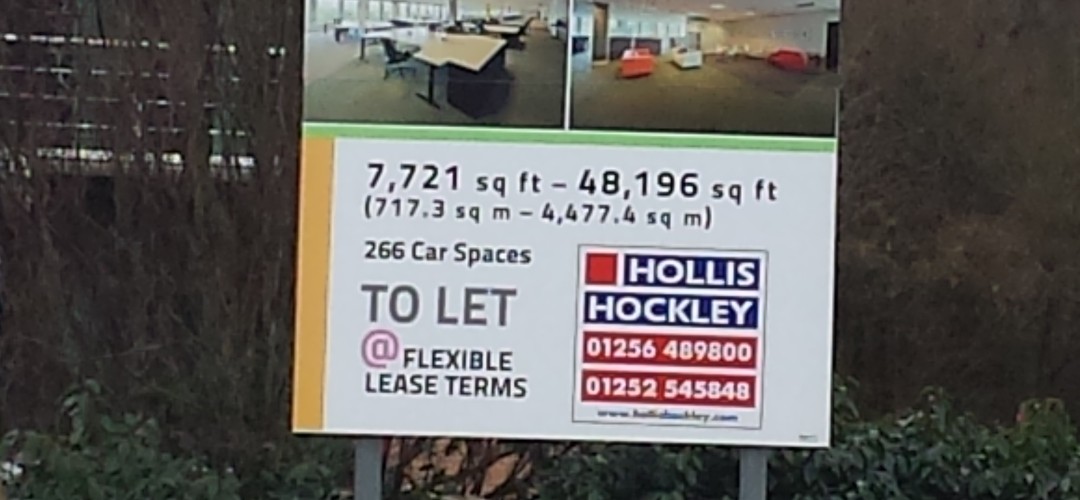

Current position of Gurkha Square

It is understood that HDC own the freehold for Gurkha Square. Currently it generates between £108,000 and £130,000 of parking revenue. As an average, let’s assume £120,000 per annum.

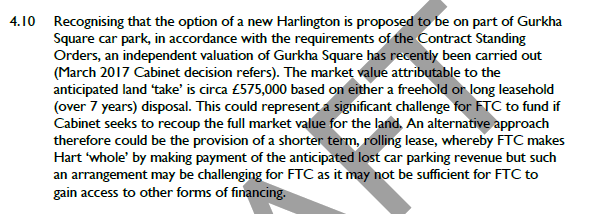

Back at the March 2017 Cabinet meeting the car park was worth between £750K and £1.3m.

More recently, at Overview and Scrutiny Committee the value was set at £575K. The reason for this mysterious loss of value hasn’t been explained.

We think the valuation is on the low side. A continuing stream of parking income, which is likely to be rise in line with inflation each year, might be valued at a multiple of 16 or above. This would value the car park at nearly £2m.

An alternative approach might be to value it as development land with planning permission. The SHMA suggested development land in Hart is worth £4m per hectare. The site is approximately 0.3Ha. This would value the site at £1.2m. This might be considered conservative as it is a prime site in one of the most affluent towns in the UK.

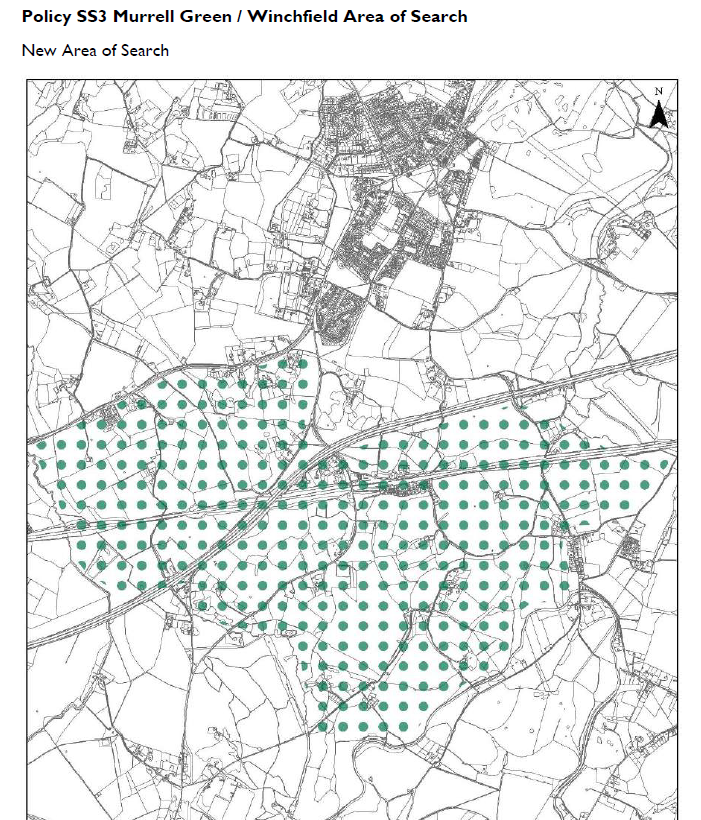

We believe that Hart wants to replace the lost parking revenue. We understand that it has been proposed that there be a ‘land swap’ where HDC give Gurkha Square to FTC and in return, FTC give HDC part of The Views. Hart would then use that land to build new parking spaces. The Views are one of the last remaining green spaces in Fleet town centre. As green space, the land has essentially zero economic value, and probably comes with maintenance costs attached.

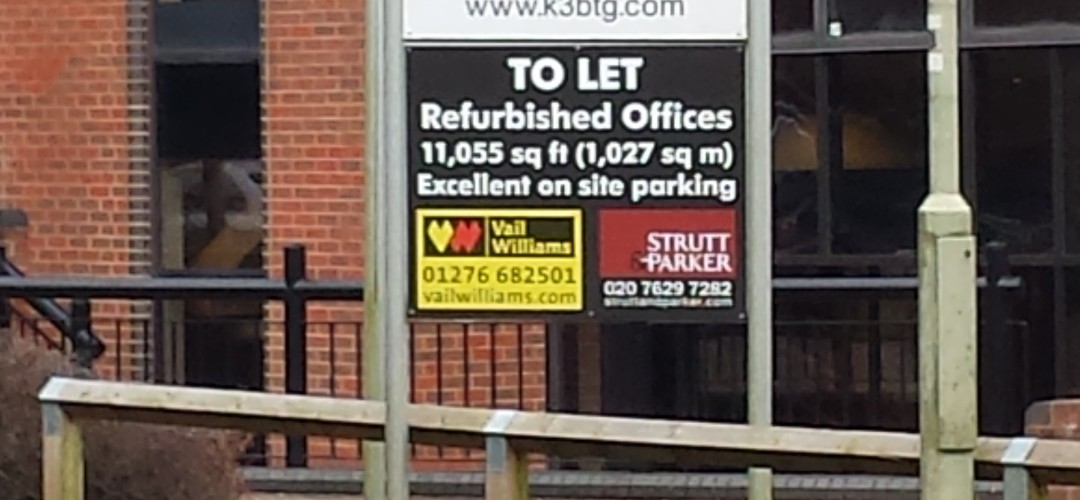

The Harlington Proposal

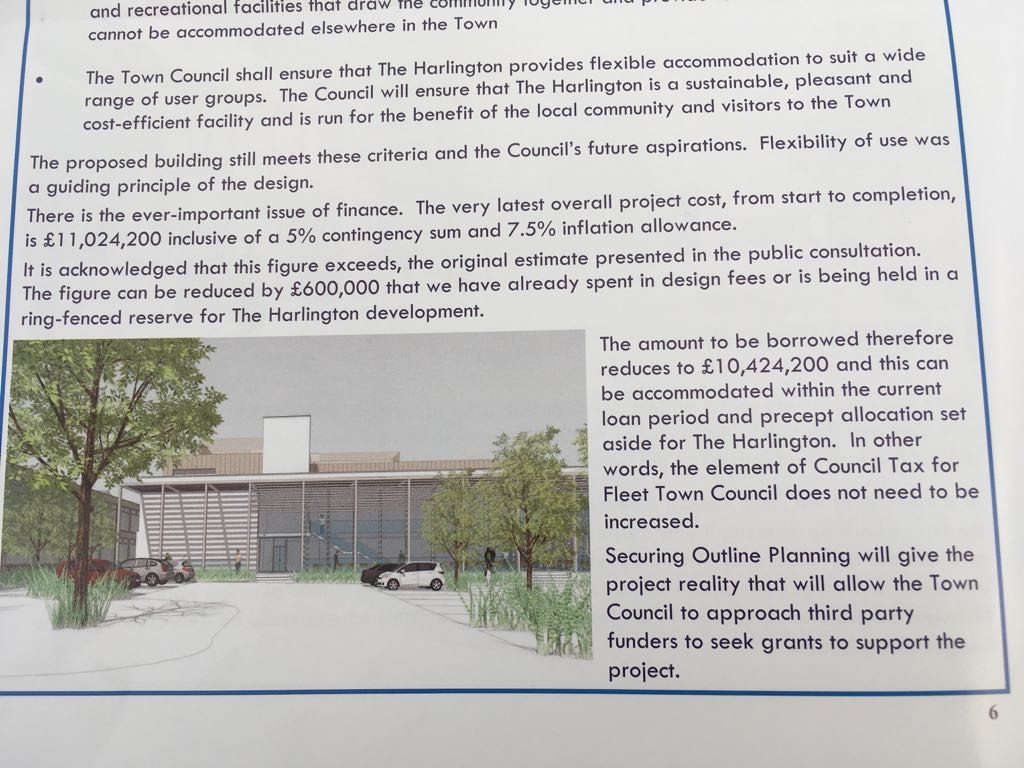

As we understand it, FTC is proposing to build the new facility on Ghurka Square car park at a cost of £9.9m. ***Stop Press: Costs now escalated to £11m***. There are no plans for what happens to the existing Harlington centre, and apparently no money either. It has to be presumed that Hart taxpayers will shoulder the costs of maintenance and security, meanwhile Hart residents gain another decaying building in Fleet.

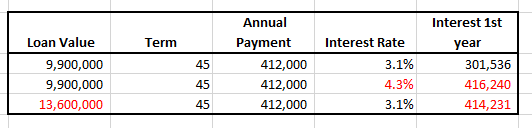

It is envisaged they will take loan to cover the cost from the Public Works Loan Board. Under this arrangement, monthly payments would remain fixed, but the term of the loan might vary depending upon changes in interest rates or cost escalations. The current plan is that the repayment period would be 45 years. 58 years based on the new £11m cost. Would the building even last that long?

FTC has committed not to increase the precept levied to fund this project above £412,000 per annum.

It is not clear what will happen if costs or interest rates rise so that the monthly payments don’t cover the interest. A quick sensitivity analysis shows that if the interest rate increases to 4.3% or above, and/or costs escalate to £13.6m or above, then the precept will not be sufficient to repay the interest, let alone repay any of the principal. We know that interest rates are rising, and construction costs only go up between project idea and completion.

Taken together, FTC is commiting to spend the continuing operating loss of £180,000 per annum plus the loan repayments of at least £412,000 per annum for the next 45 58 years. This totals at least £26.6m £34.4m over the term, assuming no further cost overruns and no interest rate increases.

The Harlington Horror Show Deal

Putting this all together, we believe this proposal is a lose-lose deal for Hart and Fleet residents. Let’s take a look at the position of Hart and Fleet taxpayers.

Hart Taxpayers

On the revenue side, they lose approximately £120K in parking income each year from Gurkha Square. They also lose the costs of maintaining and securing the decaying Harlington building. This might amount to a total of around £140K per year.

On the capital side of the account they lose Gurkha Square at a value of at least £1.2m. However, they gain part of The Views, at an unknown value. Essentially, this has no economic value as greenspace, and will probably come with maintenance costs attached.

The revenue costs could be mitigated by building more parking spaces on The Views. It is unlikely that the costs, once additional roadworks and machines are included will give much change from £500K. The resulting spaces will then be in an inconvenient position and unlikely to generate much income.

Fleet Taxpayers

On the revenue side Fleet taxpayers commit to paying at least £412K per annum for at least 45 58 years, plus £180K per year subsidy, for a total cost of at least £26.6m £34.3m. They might also gain parking revenue from the remaining car park.

On the capital side, they gain Gurkha Square at a value of £1.2m. However, they lose part of The Views at unknown value. Of course they gain a brand new building at a value of £9.9m £11m.

Taken together, this is the Harlington Horror Show.