We have uncovered some financial challenges to the Harlington Project to build a new facility on Gurkha Square in Fleet, Hampshire. Sadly, we have found that Fleet Town Council’s numbers don’t add up.

In summary, it is unlikely the project as currently constituted would meet Government lending criteria, without a significant precept increase. Moreover, Fleet taxpayers are on the hook for further increases in the precept if costs were to increase by even a modest amount.

If you want to do something about this, please respond to the petition that can be found here.

Please also object to the planning application here (or search for application 18/00147/OUT on https://publicaccess.hart.gov.uk/ )

Here is detail of the facts as we understand them, that have led us to the conclusions.

First, just to remind you, Fleet Town Council (FTC), is currently proposing to borrow £10,424,200 over 46 years to fund the vast majority of the project cost. The current total cost is estimated at £11,024,200, including a 7.5% estimate of inflation and 5% contingency. They have committed to keeping the annual precept on Fleet residents at £412,000 per year.

Will the Government approve the loan for the Harlington Project?

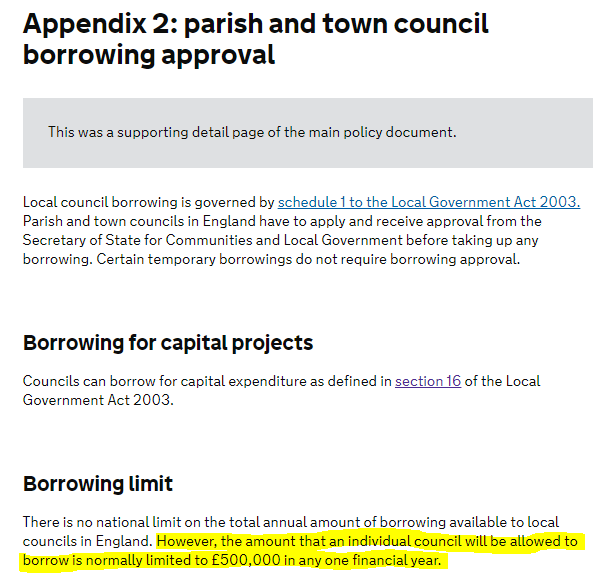

FTC has stated that it will seek a loan from the Public Works Loan Board (PWLB) to finance the Harlington project to build a replacement building on Gurkha Square. The PWLB does indeed make such loans, but each loan has to be approved by the Government. Not surprisingly, the Government has set guidelines on how much parish and town councils can borrow.

This leads us to the first challenge. The Government has said:

The amount that an individual council will be allowed to borrow is normally limited to £500,000 in any one financial year.

In short, FTC is proposing to borrow more than 20 times the amount that is normally allowed. Therefore, there must be a doubt that the loan will ever be made.

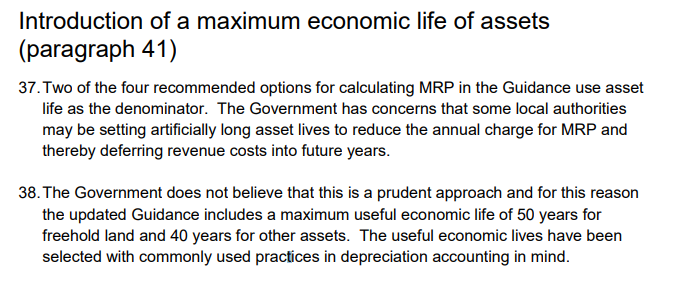

However, there is another challenge. In the current consultation on the prudential framework for capital finance of Local Government, maximum asset lives have been set. Freehold land gets a life of 50 years. Other assets have a maximum asset life of 40 years.

Eagle eyed readers will have spotted that the maximum term that the Government will allow for buildings is less than the loan term that FTC is proposing. It isn’t even clear that the Government would allow an asset life of 40 years for such a building. This must lead to FTC increasing the precept to finance the reduced loan term (see sensitivity analysis below). Therefore, before any further cost increases, FTC has already broken its commitment to local taxpayers – see below.

Sensitivity of the Harlington Project to Cost Increases

The current proposal from FTC of total project costs of ~£11m, with council needing to borrow £10.4m to fund the build. This project costs figure includes 7.5% provision for inflationary increases and a 5% contingency. Given that stage the project has reached, we think 5% contingency is very low.

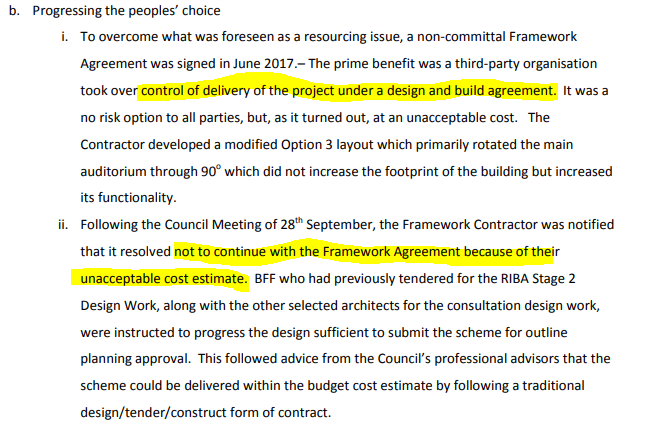

This is borne out by FTC’s discussions last year with a Design and Build contractor. This might have been a way of FTC off-loading the risk of cost increases to the private sector. Of course, they would have had to pay a premium to cover this risk. However, the cost estimate put forward by the contractor was ‘unacceptable’, so FTC have decided to go it alone with some support from Rushmoor Borough Council.

So, a private company is not willing to risk its own money on there being no further cost increases. We therefore think further cost increases are a virtual certainty. A sensible contingency at this stage of design would be at least 20%. A sensitivity analysis of the costs shows:

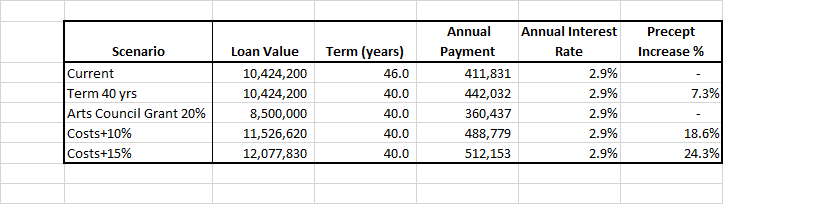

- To complete the project at the current cost estimate, with a maximum loan term of 40 years, would require a precept increase of 7.3%

- If the total project costs increased by 10% (15% over the current baseline), then the precept would need to increase by 18.6%

- A precept increase of 24.3% would be required if costs increased by 15% (20% over current baseline).

FTC is considering mitigation measures such as seeking a grant from the Arts Council. This would lead to them borrowing £8.5m. They would then have around £1.2m of headroom for cost increases before they would have to consider increasing the precept.

There is of course the risk that the fixed term interest rates that PWLB offer may rise between now and when the loan is offered.

Security of the Loan for the Harlington Project

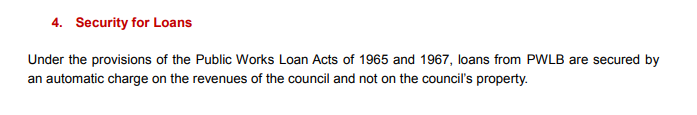

It is worth pointing out that the loan from the PWLB is different to a mortgage.

With a mortgage, the bank takes security over the property. This means it takes the future value of the property seriously. The bank needs to ensure there will be value in the property if the borrower defaults on the loan.

However, the PWLB takes a charge directly over the taxes raised by the town council, so it has no need to worry about the future value of the building being constructed. This means that if the building were to deteriorate over say, a 30 year period, Fleet taxpayers would still be on the hook to repay the loan, even though the building might be useless by then.

Be careful what you wish for.

See earlier posts: