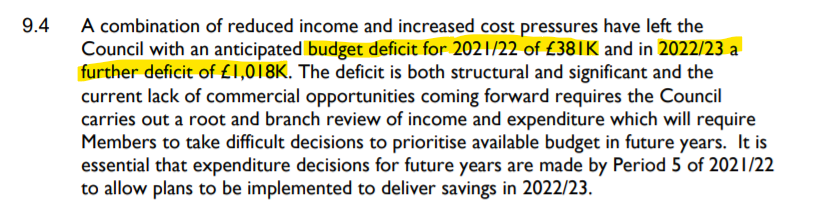

We asked a series of questions about Hart’s finances in general and Shapley Heath in particular at the Council meeting held on 29 July. Normally, we would report on the answers to these questions within a few days of the meeting. We are still waiting for some of the written answers to be provided, so we thought we should provide an update.

Regular readers may recall that CCH’s leader famously described his untrue statements about Shapley Heath in a letter to our MP Ranil Jayawardena as “rhetoric”. Unfortunately, the answers to our questions are riddled with inaccuracies and inconsistencies. It seems the CCH Rhetoric Machine has been fired up again. So, we have instituted the satirical CCH Rhetoric Awards. Read on to find out which answers we awarded the prestigious Golden Cowpat.

CCH Rhetoric Awards – Summary

- Q1 Changes to Actuals for prior years: Wooden spoon for falling at the last hurdle after first giving a convincing answer.

- Q2 Big Sings in the Budget: Partially correct answer, but a Silver Cowpat for the answer clearly not being the whole truth.

- Q3 Budget does not add up: Partially correct answer, but a Silver Cowpat for the answer clearly not being the whole truth.

- Q3 Supp – Waste Contract: Temporary Silver Cowpat award, but we reserve the right to upgrade to a Golden Cowpat if the external consultants don’t find the missing £1.1m.

- Q4 Shapley Heath Budgets: Coveted Golden Cowpat for the level of rhetoric.

- Q4 Supp Shapley Heath Spending: The “Not Me Guv” Sloping Shoulder Award and the Artful Dodger Prize for avoiding the question.

- Q5 Shapley Heath Baseline Studies: Special Sword of Truth award for this answer that revealed developers are funding the independent studies.

- Q6 £283K Transfer from Reserves: Another Golden Cowpat and the Greensill Award for Financial Transparency

- Q6 Supp How much of £500K Shapley Heath Reserves remain: Awarded the special Paul Daniels “Not a Lot” Award for not providing an answer at all. [Update] Award now rescinded because answer now provided [/Update]

- Q7 Shapley Heath Spending FY20/21: Another Golden Cowpat and the Enron Lifetime Achievement Award for Accounting Excellence.

- Q7 Supp Shapley Heath Overspend: Lord Lucan Award for the missing answer. [Update] Award now rescinded because answer now provided. Golden Cowpat awarded instead [/Update]

Let’s go through the detailed questions and answers one by one. The original question (and supplementaries) are shown in bold black. The answers are shown in blue and our commentary on the answers are shown in red.

Question 1: Changes in Actuals for Prior Years

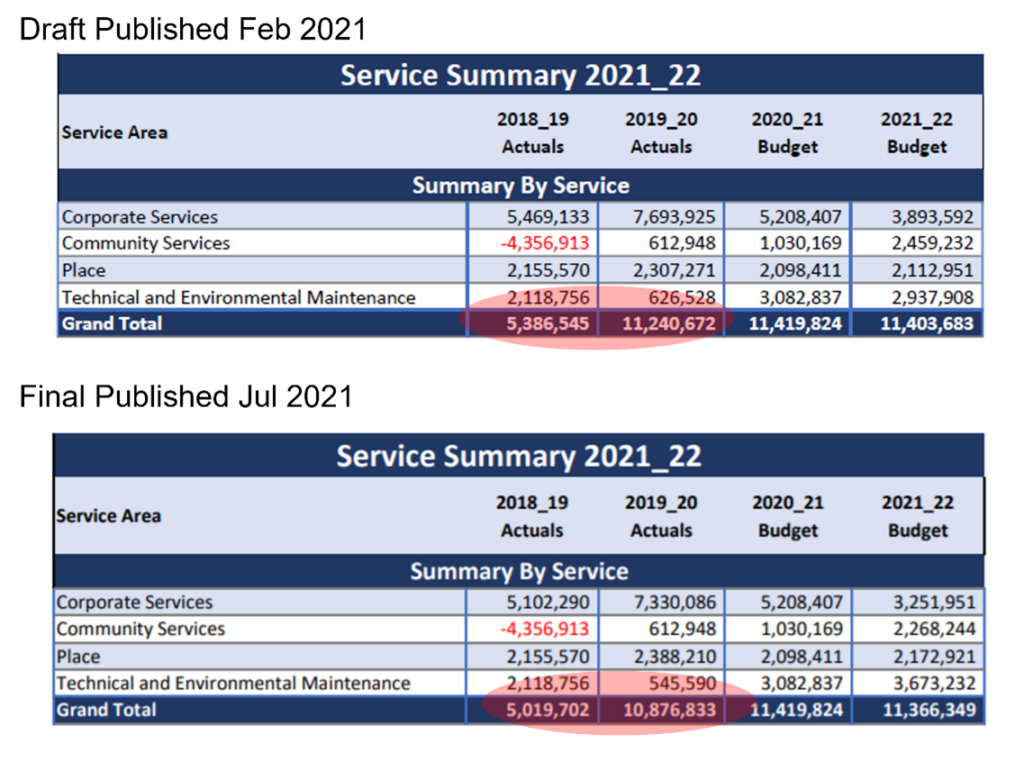

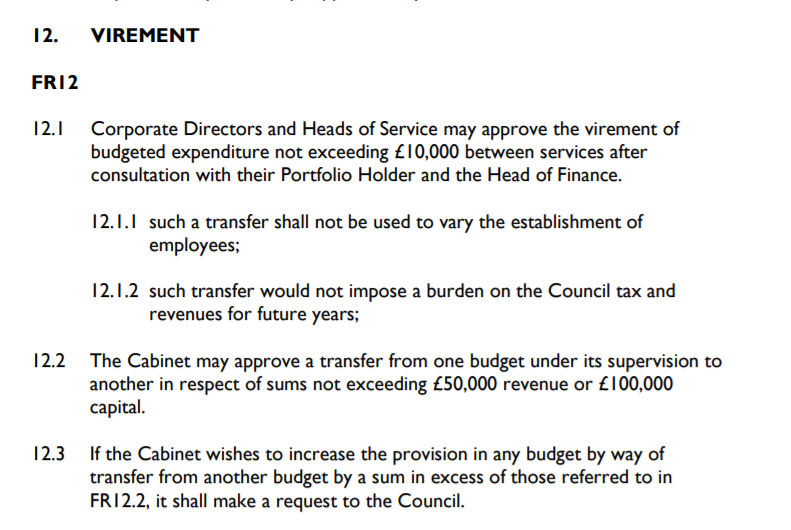

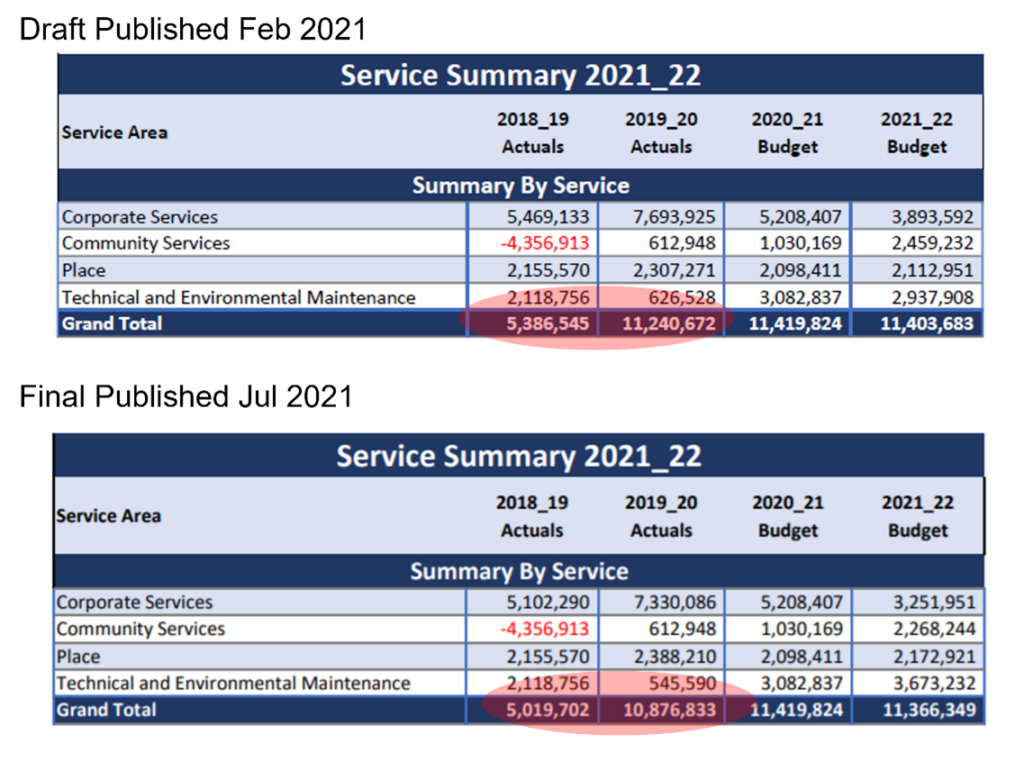

Q1. Why have the actuals for FY18/19 and FY19/20 changed between the publication of the draft budget in February 2021 and the final budget published this month [Note the actuals in the draft didn’t match the Final V2 budget either]? Is there any impact on the published statutory accounts for those years?

Hart Finances Out of Control – Changes to Actuals

A1. Before I answer any of the detail I would just like to let everyone know that we will be publishing these questions and answers, because the questions relate to tables and data whilst I will provide verbal responses I think the response will be most understandable in written format.

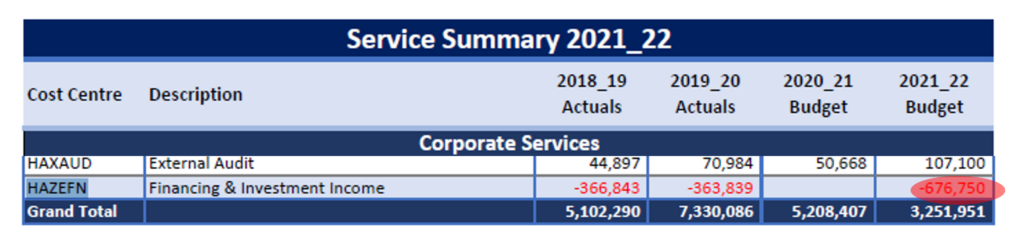

In the first table you refer to i.e. the draft budget published February 2021, interest on investments for 2018/19 and 2019/20 was excluded from the summary by service and instead included as part of below the line adjustments. For transparency and accountability this was placed above the line for reporting in the latest version of the budget book to ensure that it forms part of the detailed monthly budget monitoring process.

This has no affect on the statutory accounts which reports income and expenditure in a different format according to the CIPFA SORP.

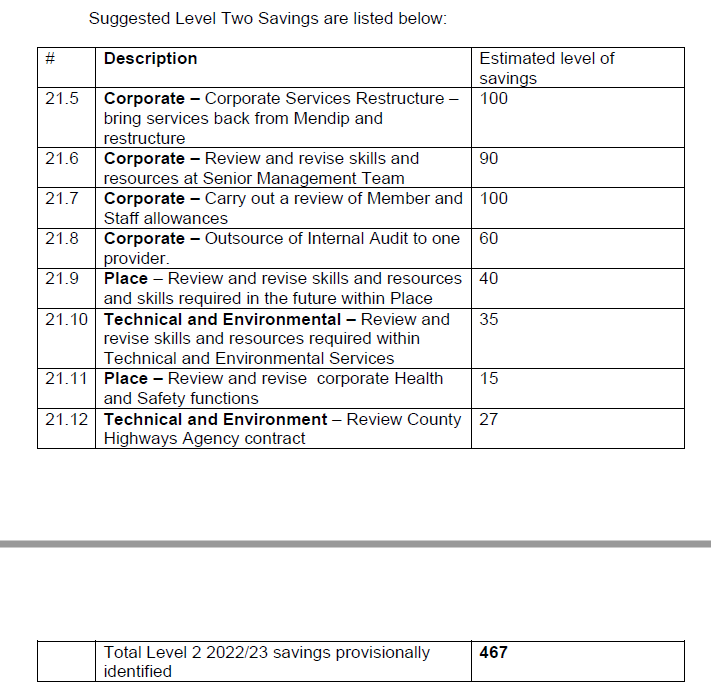

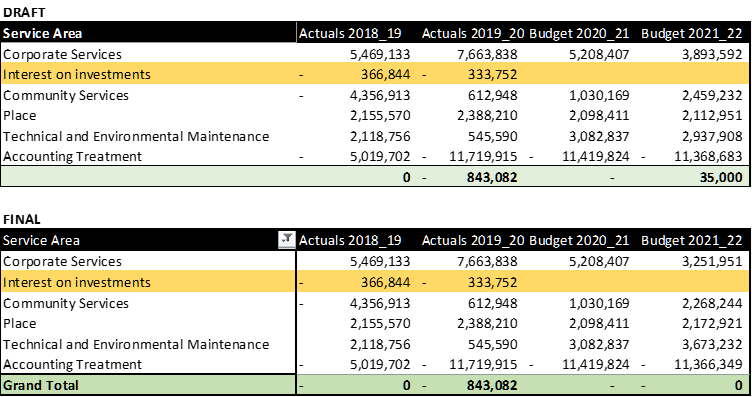

The tables below shows the detail of these line adjustments.

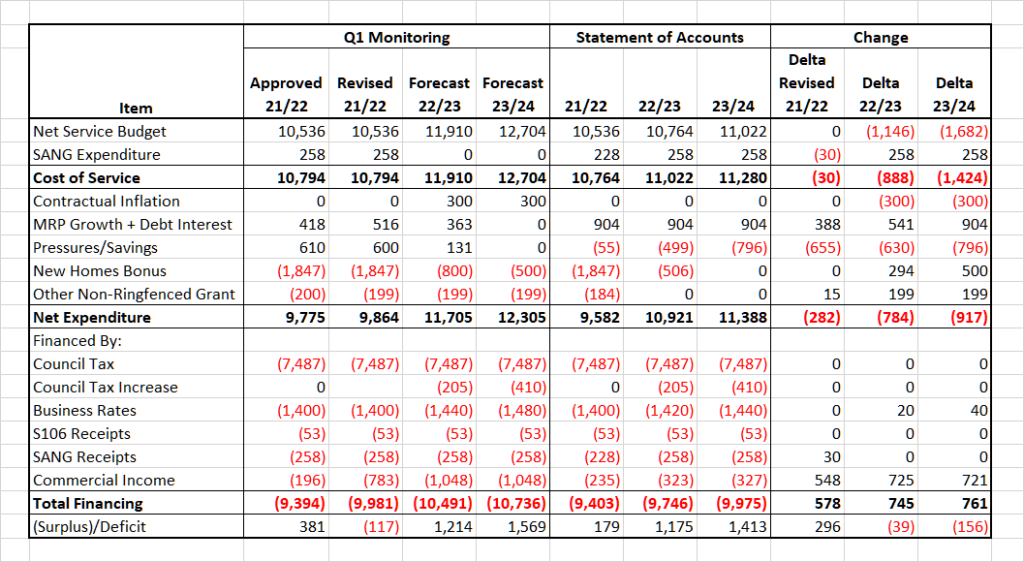

CCH Rhetoric Awards Q1 Written Answer

Our Response: On the face of it, the verbal answer given at the meeting was a reasonable explanation. However, it has been spoiled somewhat by the tables provided in the written answer which don’t match the figures for FY19/20 in the original draft budget and of course, the end balance is not zero after accounting adjustments. This opens up even more questions about control over the budgets. We shall award this answer the Wooden Spoon for falling at the last hurdle.

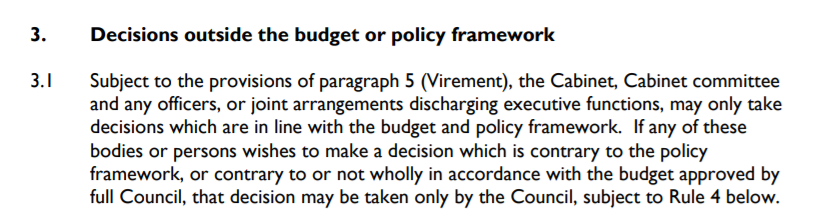

Question 2: Big Swings in Budget between Service Areas

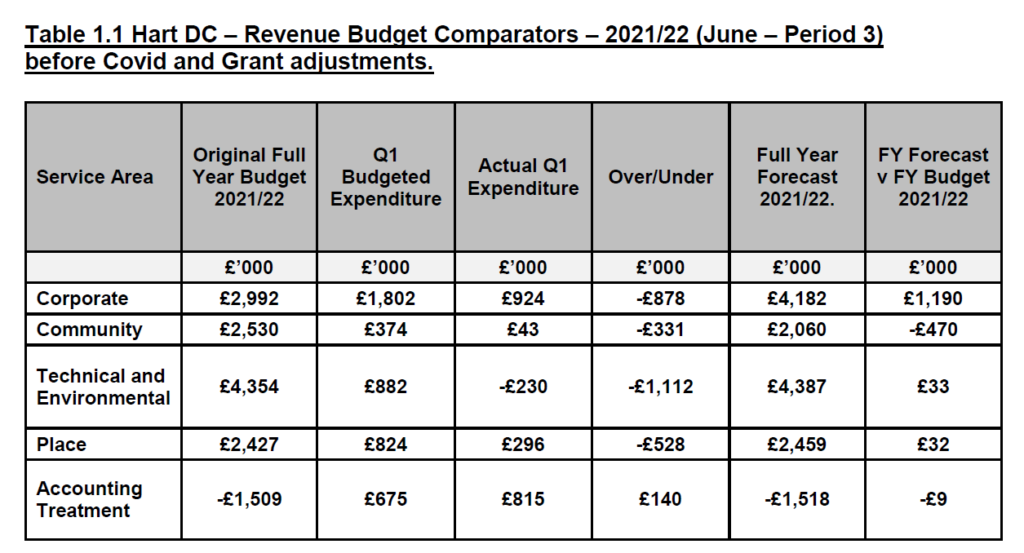

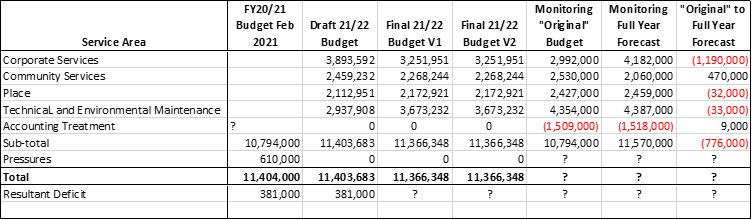

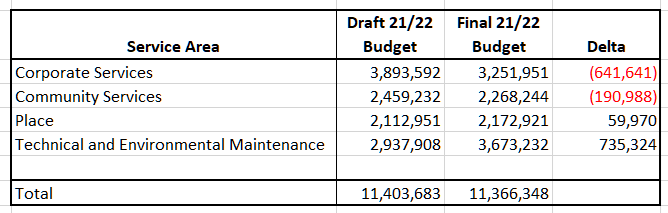

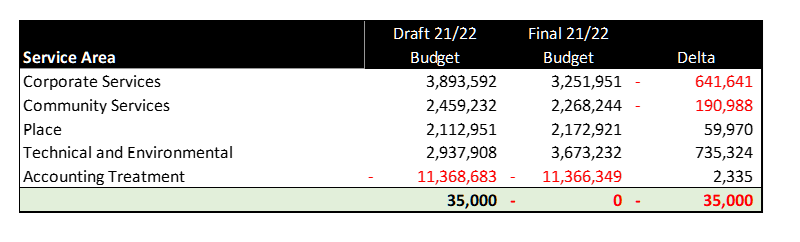

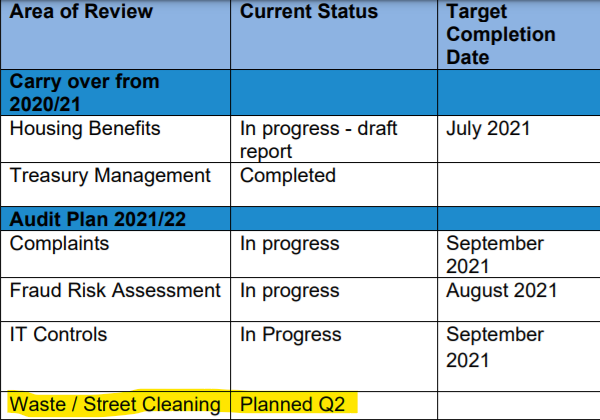

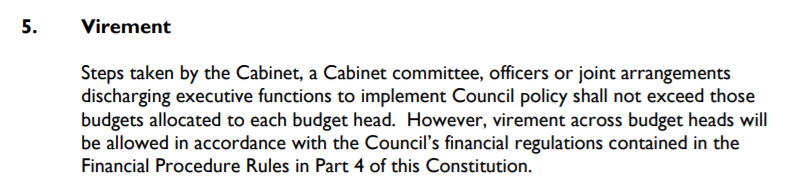

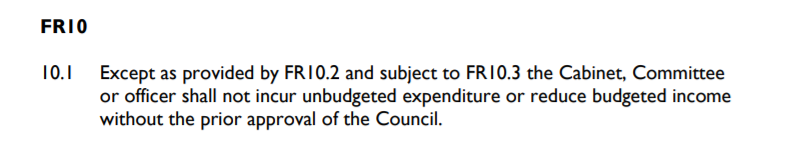

Q2. There are big differences between the budgets agreed for the Service Areas in March and final budget published this month. What governance processes were used and who authorised such massive swings in the budget and are they in accordance with the constitutional budget procedures 3 and 5 as well as financial regulations FR10 and FR12 which limit changes unless approved by full council?

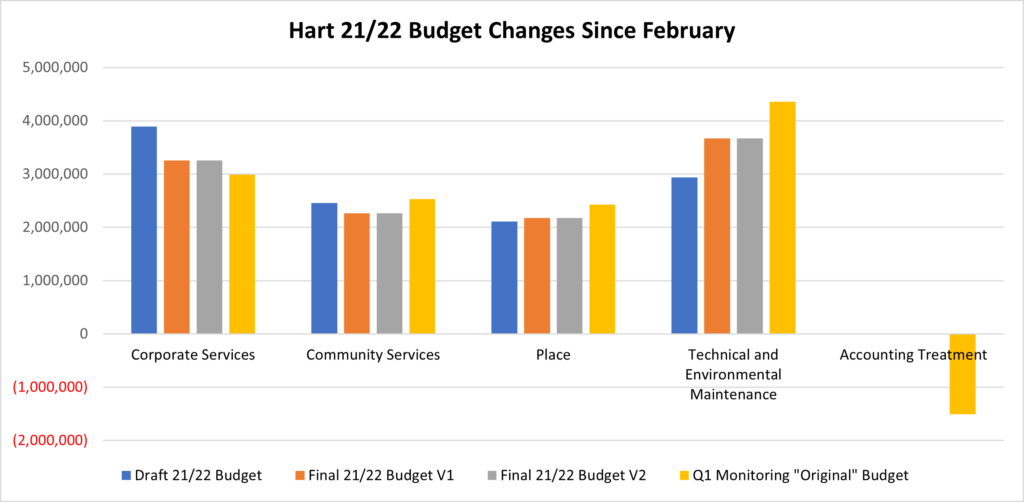

Hart Finances Out of Control – Big changes between draft and final budget

A2. There is a net difference between the draft budget and final budget of £37K

This is due to changes in the assumptions in the value of recycling credits, grants and depreciation.

The draft budget, due to its timing made assumptions based on information known at that time. As final numbers became available, they were incorporated into the Final Budget.

In summary the following updates were made.

-

- Grants – estimated numbers were used at the time of the Draft Budget. As final details were received these were incorporated into the final budget and categorised into the correct Service Area.

- SANG allocation in Tech & Environmental – S106 reserves were released which fund the SANG cost centres. This allocation was not included in the Draft Budget.

- Depreciation: Final asset valuation reports were not available at the time of the draft budget these numbers were updated for the final budget.

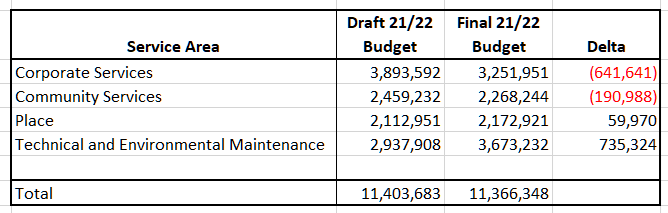

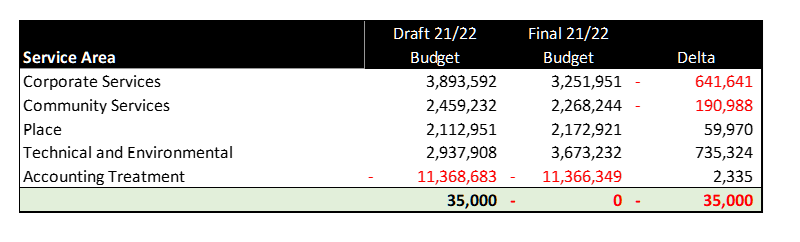

Q2 Written Answer

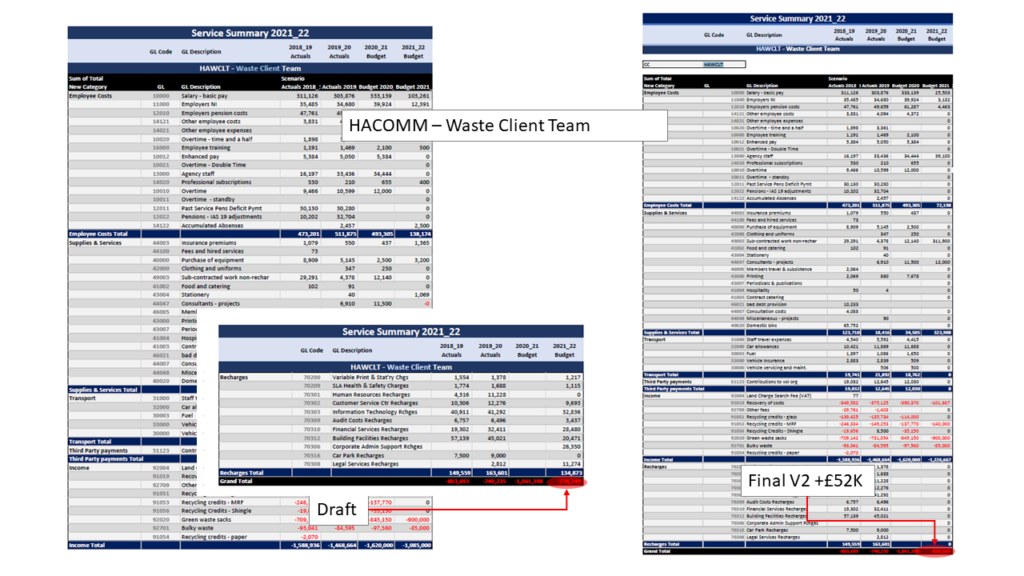

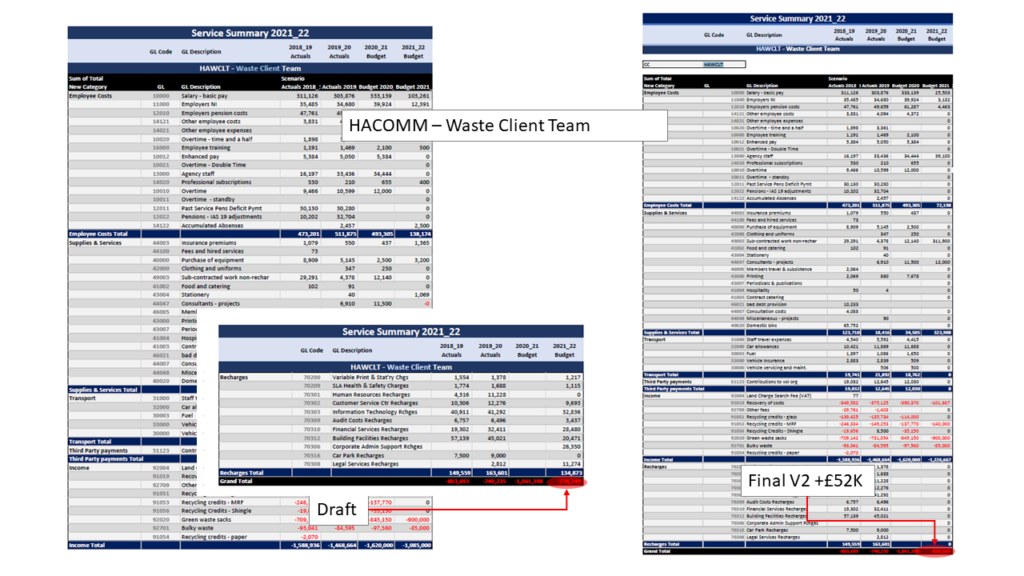

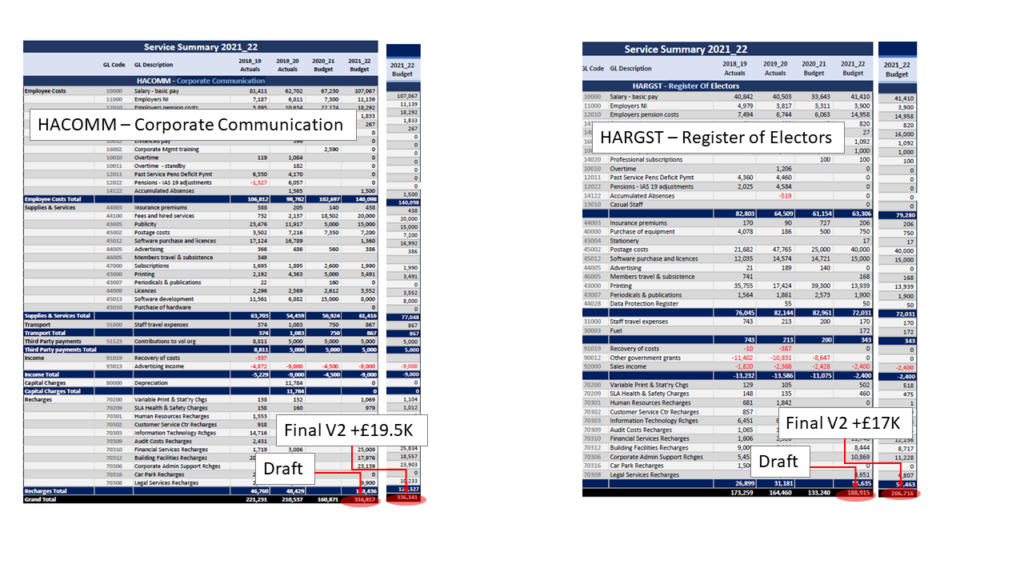

Our Response. First, the swing of £37K overall is larger than the £10K that needs to be signed off by Cabinet. Moreover, the rest of the explanation given does not hold water. Swings of >£10K are apparent in some services. For example, the Waste Client Team net income budget has fallen £52K, more than the limit that needs to be signed off by Full Council. The budgets for Corporate Communications (+£19.5K) and Register of Electors (+£17K) have higher spending even though they are not affected by the explanation given. In effect, a different budget is now in operation to that which was signed off by Council.

This is another example of poor budgeting and inadequate oversight and governance. We give this a Silver Cowpat award. The answer had some merit, but is clearly not the whole truth.

Waste Client Team Budget Changes

Other Budget Changes

Question 3: Budget Does Not Add Up

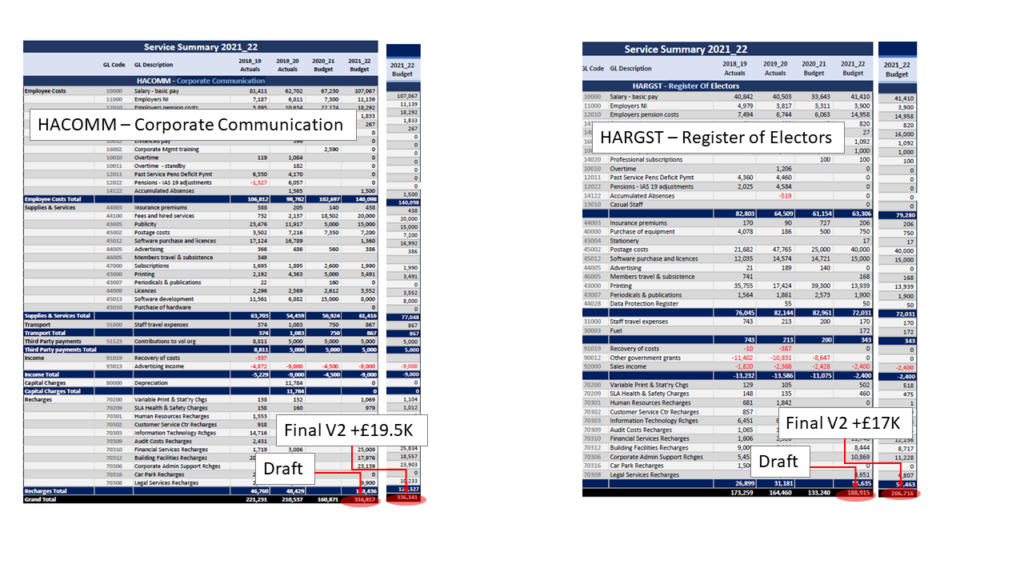

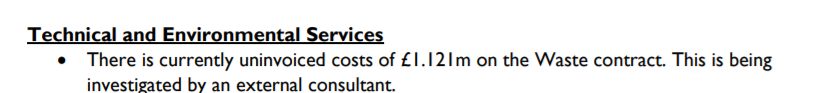

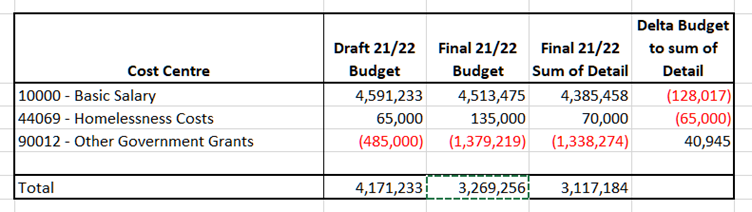

Q3. In the recently published final budget for FY21/22, the sum of the spending in the service areas for GL Codes 10000 – Basic Salary, 44069 – Homelessness and 90012 – Other Government Grants is not equal to the total for those GL Codes in the “Subjective” summary. In short, the budget apparently does not add up. It appears as though HANEED is missing from the service areas. What steps are being taken to make the budget internally consistent and what impact will correcting the errors have on the projected deficit?

Hart Finances Out of Control – Budget Does Not Add Up

A2: The HANEED cost centre detail page was missing from the scanned copy of the paper copy of the Draft budget book. The budgetary numbers were not missing from the overall numbers. This is a matter of presentation.

Additional checks will be incorporated into the process for future publications.

Our Response. Again, this is not a complete answer. First, it refers to the draft budget published in February. However, despite being pointed out by email at the time to all Councillors, the JCX’s and the S151 Officer, the draft budget was passed with the error. However, the same error persisted into the Final budget published in early July. The question related to the Final budget. This was corrected when it was drawn to the attention of officers. However, the error cannot simply be a “slip of the scanner”.

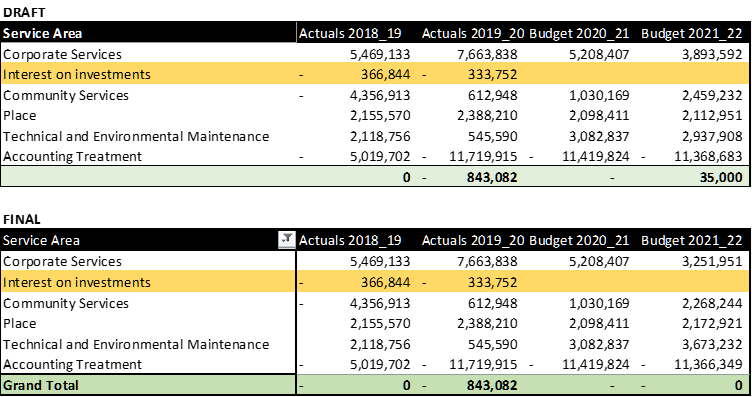

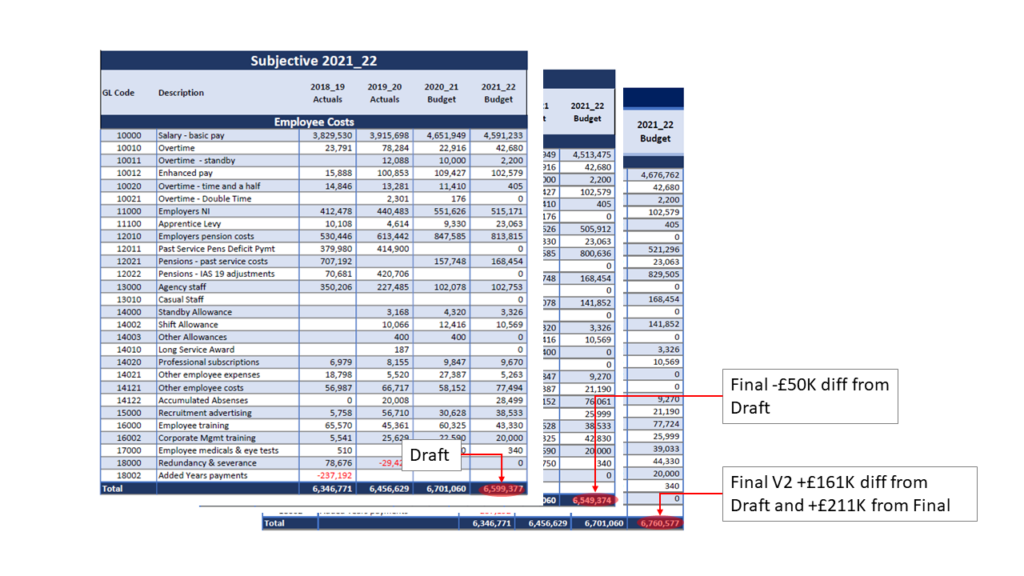

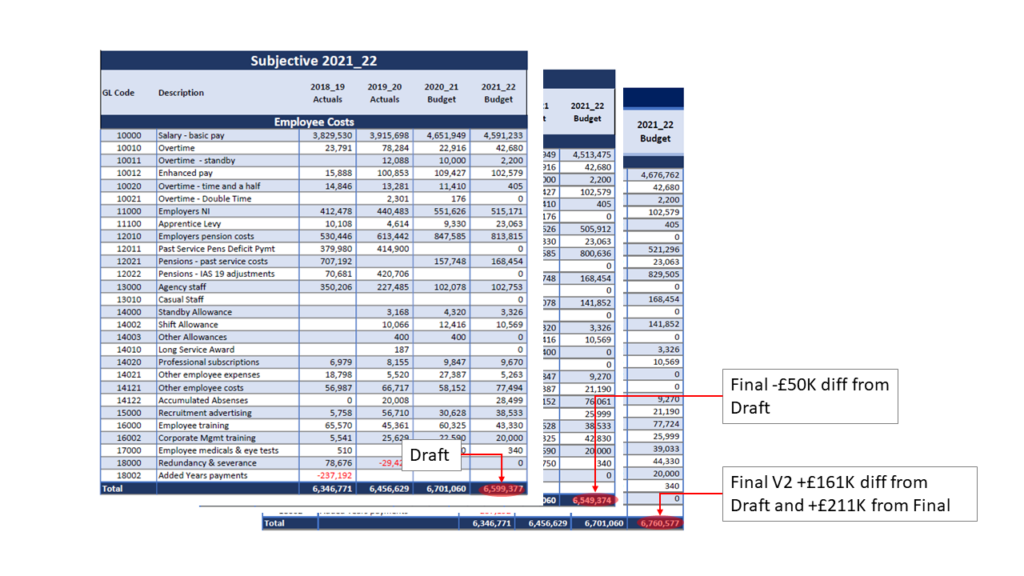

First, it seems unlikely that the scanner would miss exactly the same page five months apart. Secondly, other changes were made between the Final and Final V2 budgets. The total employee costs decreased £50K between Draft and Final, yet increased £211K between Final and Final V2. This is another example of the Council now working to a different budget to the one signed off in February. We give this answer another Silver Cowpat award. The answer had some merit, but is clearly not the whole truth.

CCH Rhetoric Awards Employment Cost Changes

Q3 Supplementary – Waste Contract

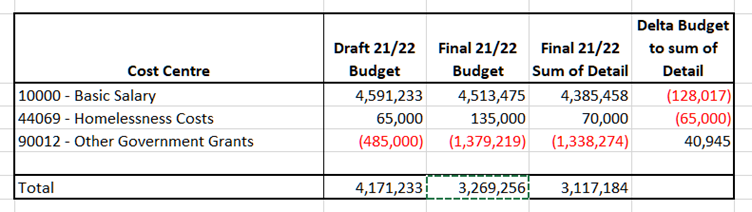

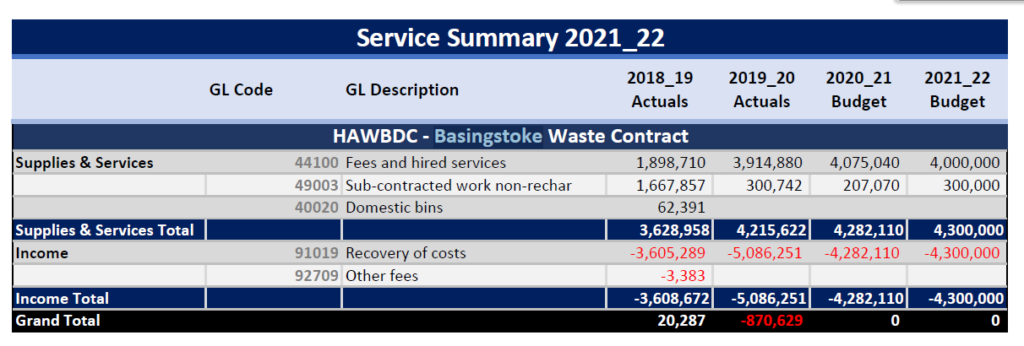

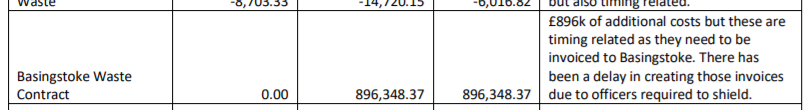

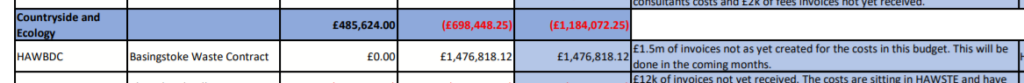

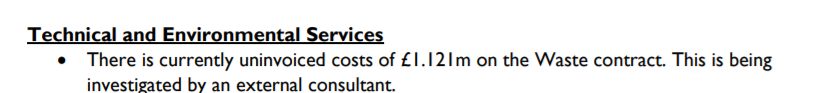

Q3 Supp: Have the ever-changing budgets and persistent errors impacted on the Waste Contract, where over one million pounds appears to have been lost down the back of the sofa?

A3 Supp: I can reassure you that that is not the case. Following the reconciliation of costs of the waste contract as part of the handover of the client management to Basingstoke costs of £1.1 million remained under a rechargeable cost code. It was agreed with Basingstoke that we would bring in independent specialists to review these costs, how they should be accounted for, and whether they should be rebilled. This work has started, and early indications are that this dates back to 2018 and investigations are continuing. This is an accountancy artifact which relates to the council cross charging. There is every expectation that these charges balance out with other charging which has flowed in the other direction. The net affect being zero. This is simply an accounting artifact.

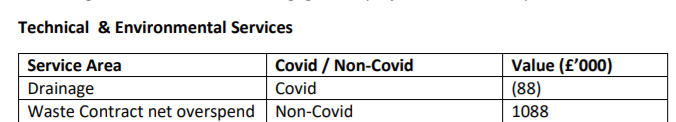

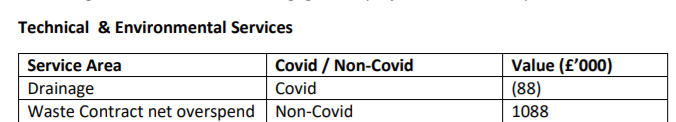

Our Response. If this missing money is just an “accounting artifact” with a “net effect of zero”, why is it recorded as an unfavourable variance in papers to Overview and Scrutiny and to Cabinet? Both papers presented by none other than Councillor James Radley. The same overall variance has made its way into the statutory accounts due to be audited shortly. If the problem dates back to 2018, doesn’t this call into question the accuracy of the accounts from earlier years?

We give this a Silver Cowpat award, because there is an outside chance the external consultants find the money. But we reserve the right to upgrade to the coveted gold award.

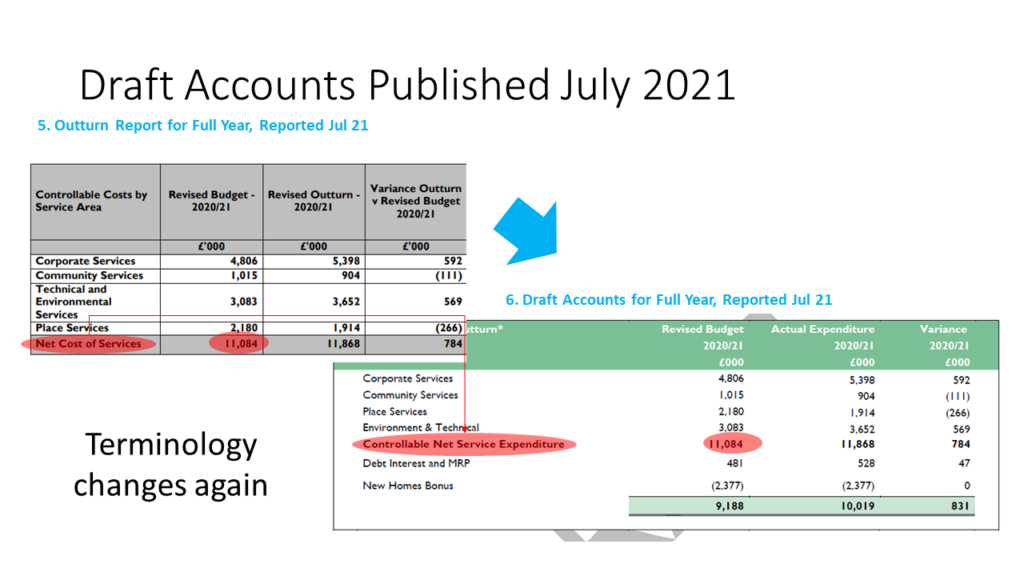

HAWBDC Basingstoke Waste Contract £1.121m uninvoiced at year end reported June 2021

HAWBDC Basingstoke Waste Contract £1.088m overspend reported Jul 2021

CCH Rhetoric Awards Question 4: Shapley Heath Budgets

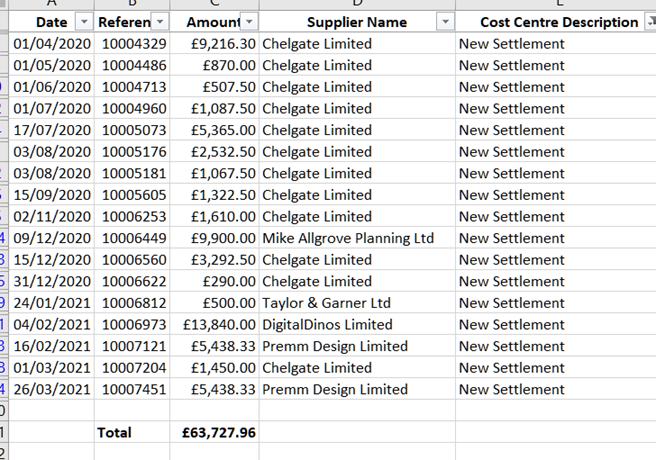

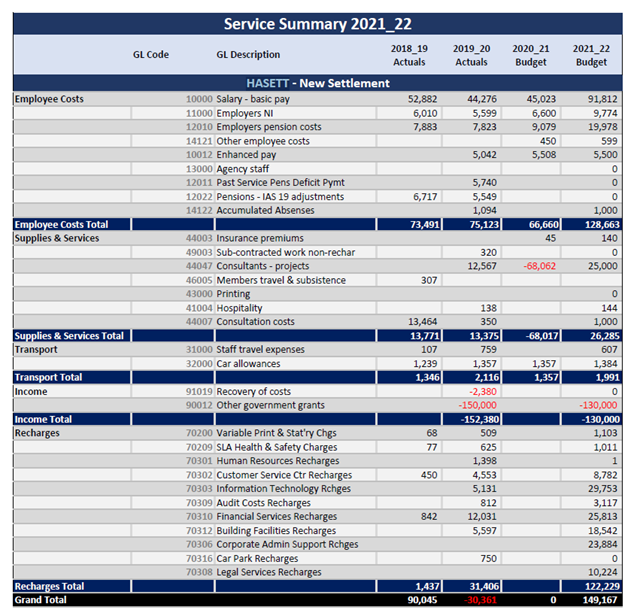

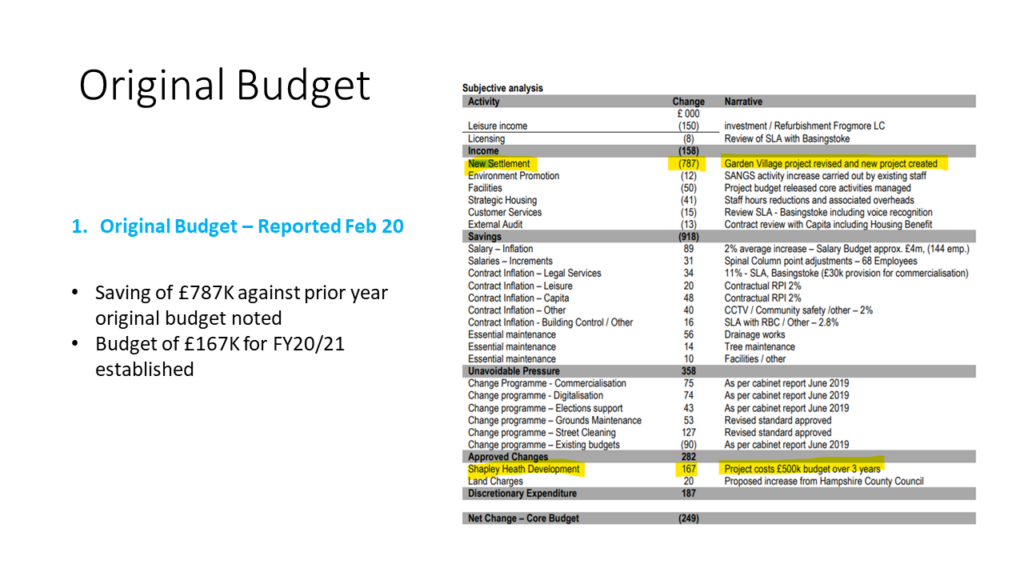

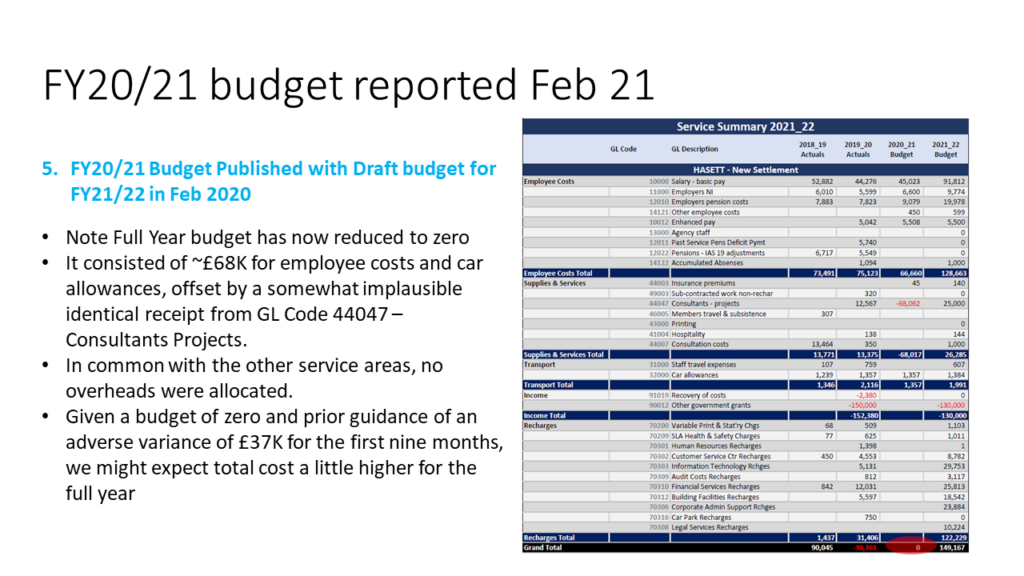

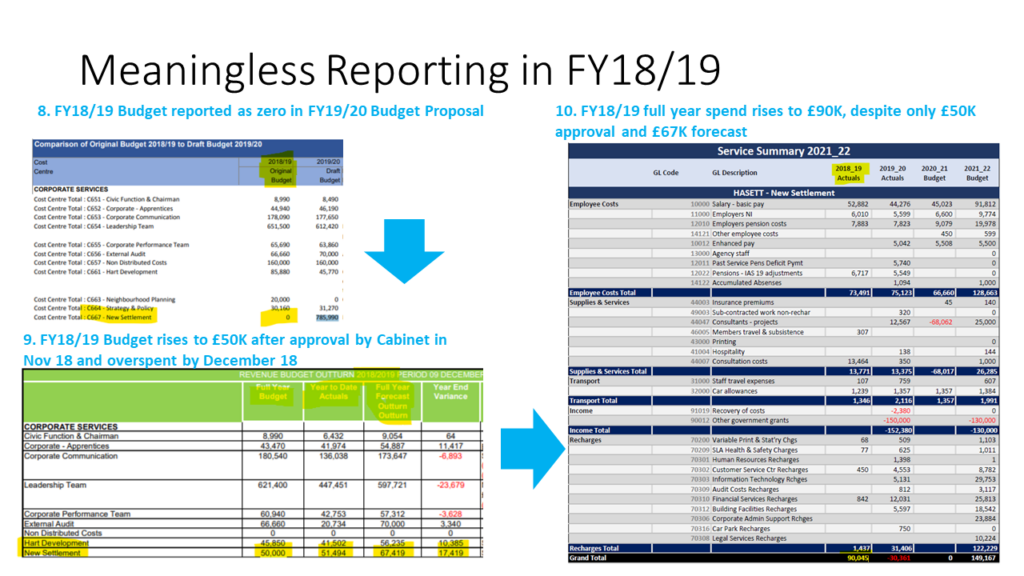

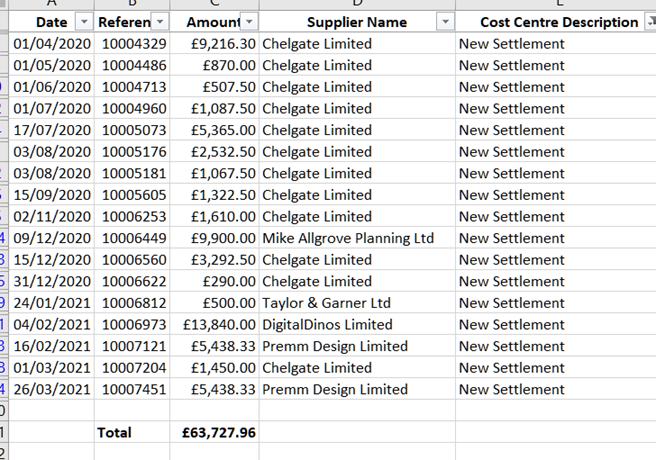

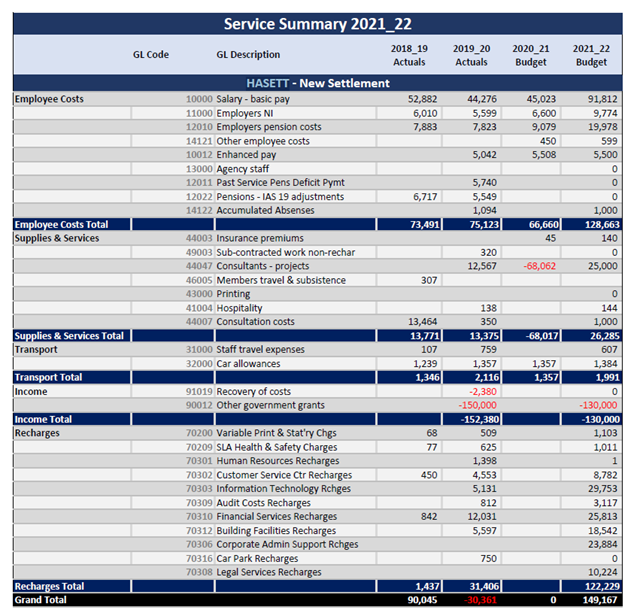

Q4. The recently released final budget for FY21/22 shows that the budget for HASETT – New Settlement in FY20/21 was zero. It consisted of ~£68K for employee costs and car allowances, offset by a somewhat implausible identical receipt from GL Code 44047 – Consultants Projects. In common with the other service areas, no overheads were allocated. Yet, the transparency report shows spending of £63.7K on consultants (not money received from) in “New Settlement” for FY20/21. What governance processes were used to authorise such a large spend against an overall zero budget, apparently in contravention of FR10 in the constitution?

Shapley Heath New Settlement Transparency Report FY20-21

A4: The New Settlement published budget for 20/21 did not reflect the release of reserves agreed by Cabinet in February 2020.

These reserves were drawn down at the end of the year on assumption of agreement made by full council on the 6 February 2020 and approved by Cabinet.

Our Response. We have scoured the document referred to. The only references we can find to Shapley Heath are:

-

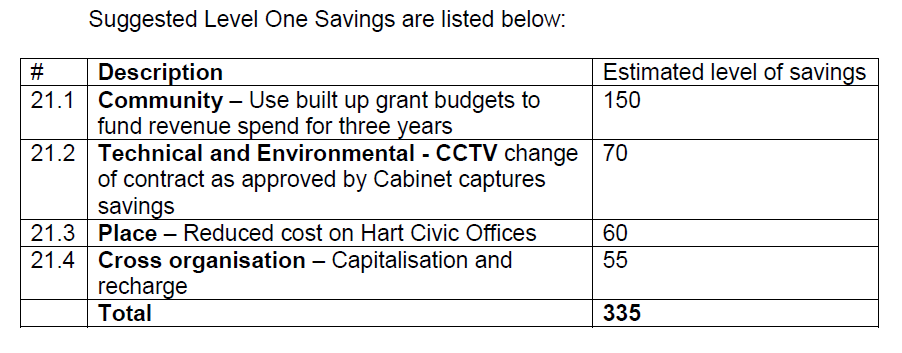

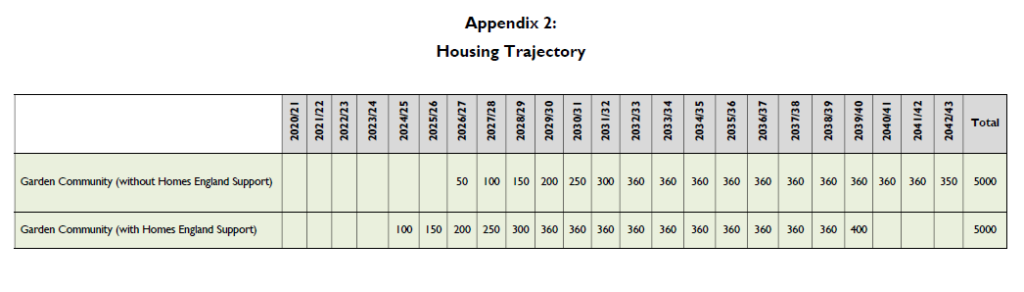

- It being described as a “pressure” requiring £500K of spending over 3 years

- £167K of discretionary spending allocated in the FY20/21 budget

We do not believe that setting a budget is the same thing as releasing reserves. In any event, the budget should reflect the spending required, and a release of reserves is not “income”. As Councillor Radley has said himself, moving money from reserves is the equivalent of moving money from your savings account to your current account to cover an overdraft.

Oh, and the Council meeting to approve the budget took place on 27 February 2020, not 6 February. We give this answer the coveted Golden Cowpat for the level of “rhetoric”.

Q4 Supplementary FY21/22 Shapley Heath Spending

Q4 Supp: Hart recently advertised Garden Community contracts with an indicative value of £56K, against a FY21/22 budget of £25K, isn’t it time for some proper forensic accountants to get to the bottom of what’s going wrong with budgeting and financial controls?

Answer A4 Supp [On the Night]. I am not in a position to comment on how Place department operate, but we do maintain that our departments, at the end of the year have balanced their budgets and I am quite convinced they are working within those limits.

Answer A4 Supp [Written Answer]. The Council operates internal controls across the organisation. These include budget monitoring, budget virements and spend approval. The Shapley Heath project is subject to these same budgetary controls as all other projects/activities.

Details of these controls can be found within the published Hart Constitution – Financial Regulations and Contract Standing Orders. Hart Consitution [sic]

Our Response: First, Shapley Heath is a Corporate Services project, one of the areas that Councillor Radley is responsible for. The rest of the answer does not address the question posed. The “Not Me Guv” Sloping Shoulder Award and the Artful Dodger Prize for avoiding the question on this one.

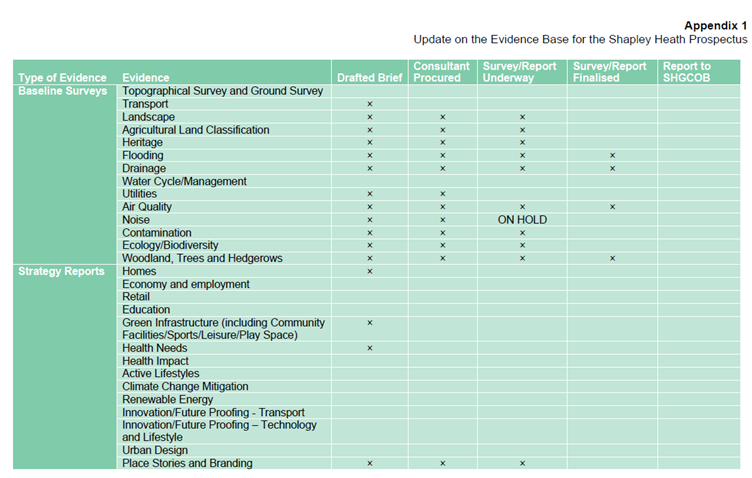

CCH Rhetoric Awards Question 5: Shapley Heath Baseline Studies

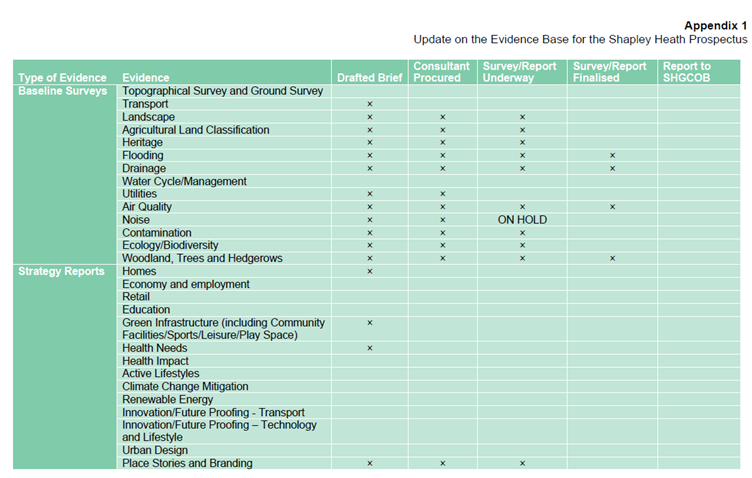

Q5: In addition, the Shapley Heath Opportunity Board papers show that four Baseline Studies had reached the status of “Finalised” by 8 March, before the end of the Financial Year. These must have cost money, but do not show on the Transparency Report nor on the Contracts Register. How much was spent on Baseline Studies and Strategy Reports in FY20/21?

Shapley Heath Baseline Studies as of 8 March 2021

A5: The Shapley Heath Opportunity Board Papers clearly state that the Baseline Studies were funded by promoters. No money was spent by the Council on Baseline Studies or Strategic Reports in 2020/21.

Our Response: It does seem more than odd that Councillor Radley should proudly proclaim that none of the £283K transferred from reserves was spent on anything useful for the project. It’s looking like the HDC project team is little more than the PR department for the developers. And we are paying for it. If the Baseline Studies were funded entirely by developers, how can they be relied upon to be impartial? Are HDC really going to base their Shapley Heath strategy on documents funded and sourced from the developers? What ever happened to a council led project? We give this answer a special Sword of Truth award.

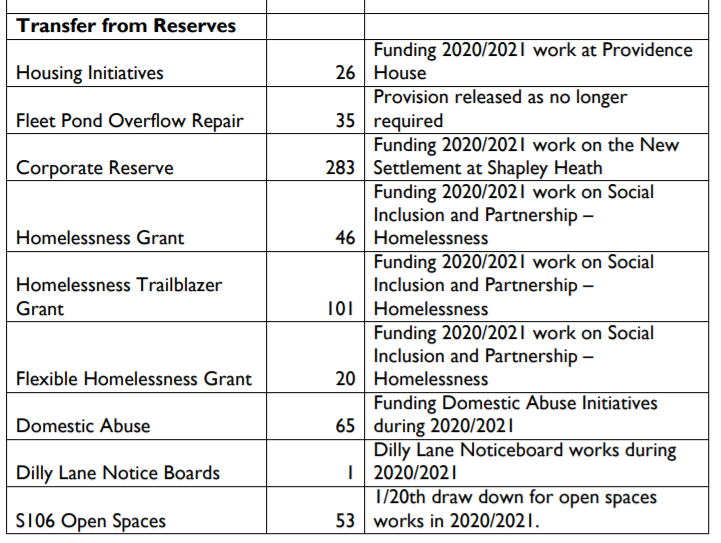

Question 6: Governance Arrangements for £283K Transfer from Reserves

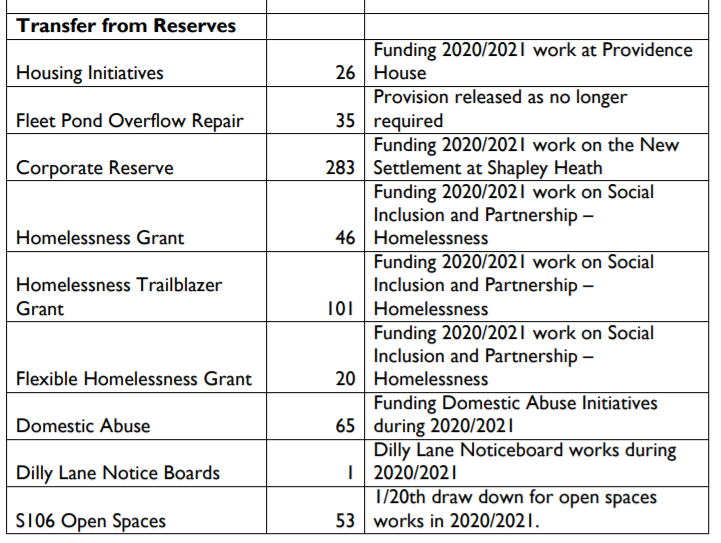

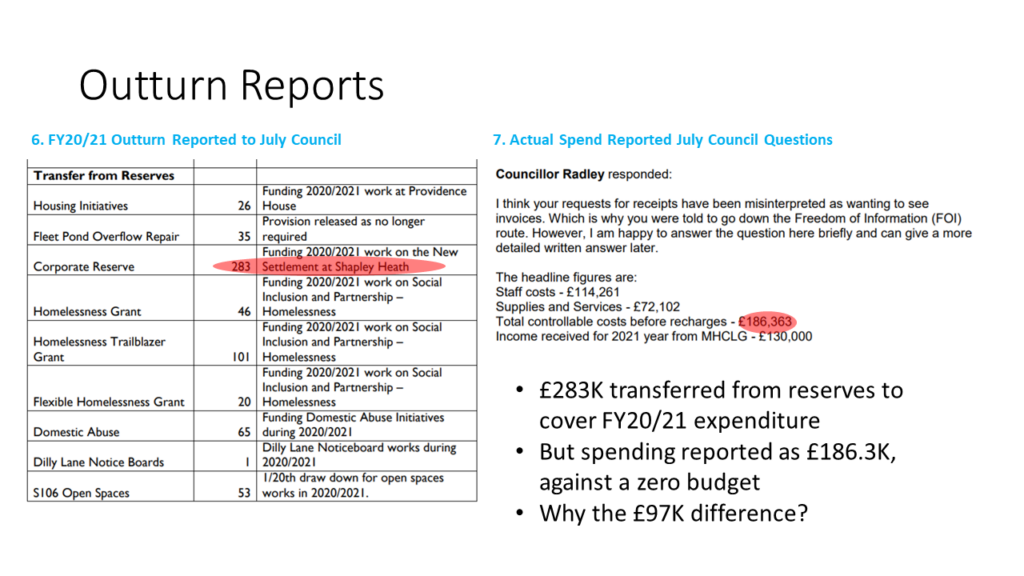

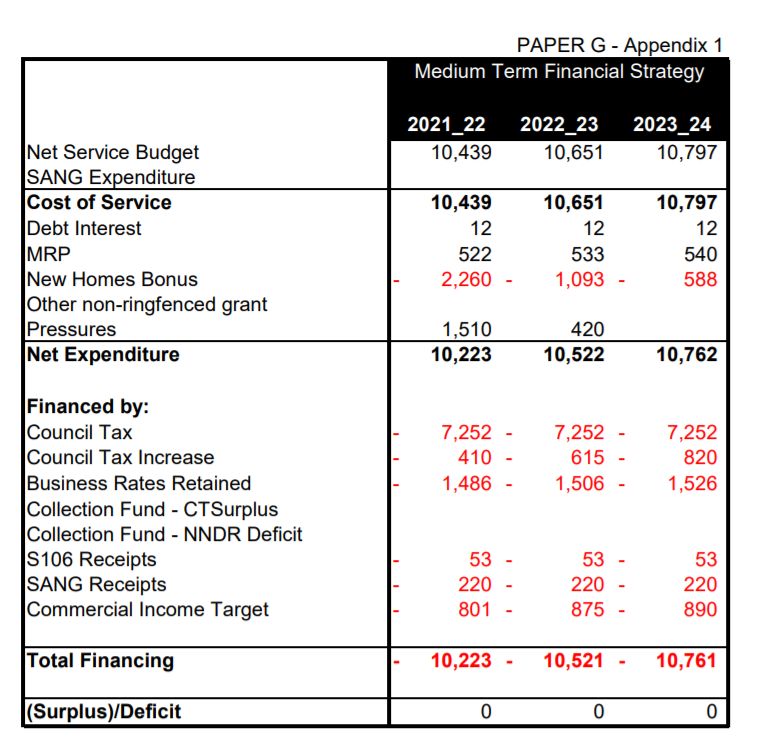

Q6: The agenda pack for July Cabinet shows that £283K was transferred from reserves to fund Shapley Heath. How is it possible to spend £283K against a zero budget whilst running a deficit and what governance processes authorised this spend?

Shapley Heath £283K Transfer from Reserves

A6: Expenditure for Shapley Heath spend was presented to Cabinet on the following dates:

Shapley Heath is funded by Government Grants. Grants have been received over several years. With Cabinet’s consent, grant funding can be transferred to and from an ear-marked reserve between financial years. Members provided the approval for a £283K transfer from reserves at Cabinet on the 3rd July to fund 20/21 expenditure. This paper was subject to scrutiny by the Overview and Scrutiny Committee.

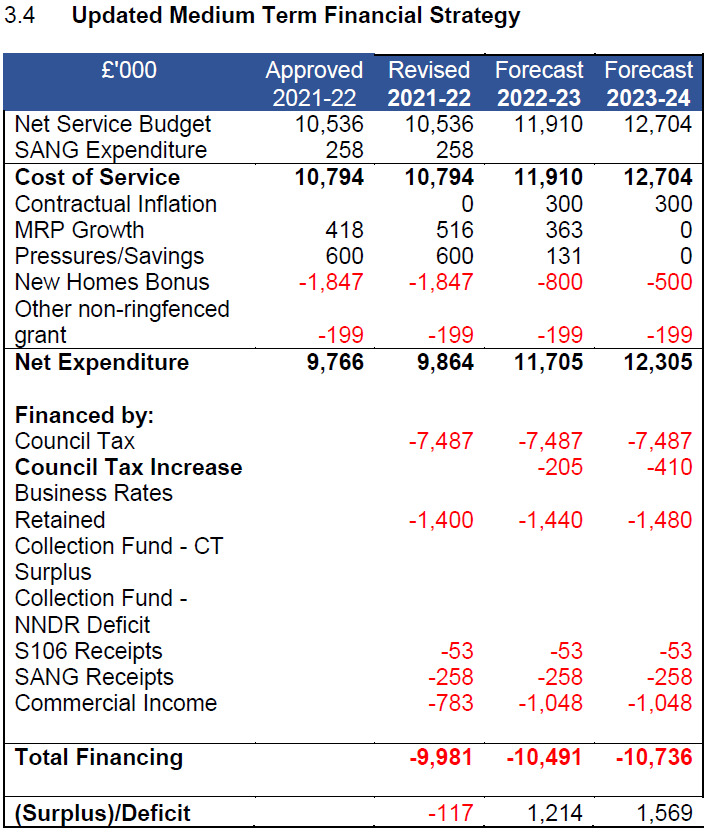

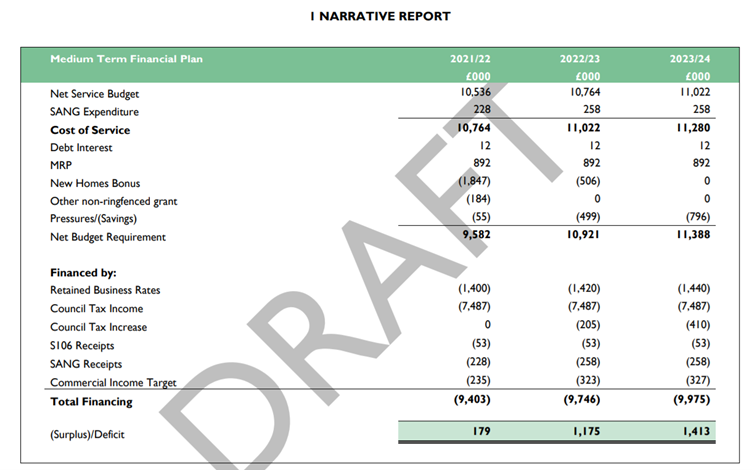

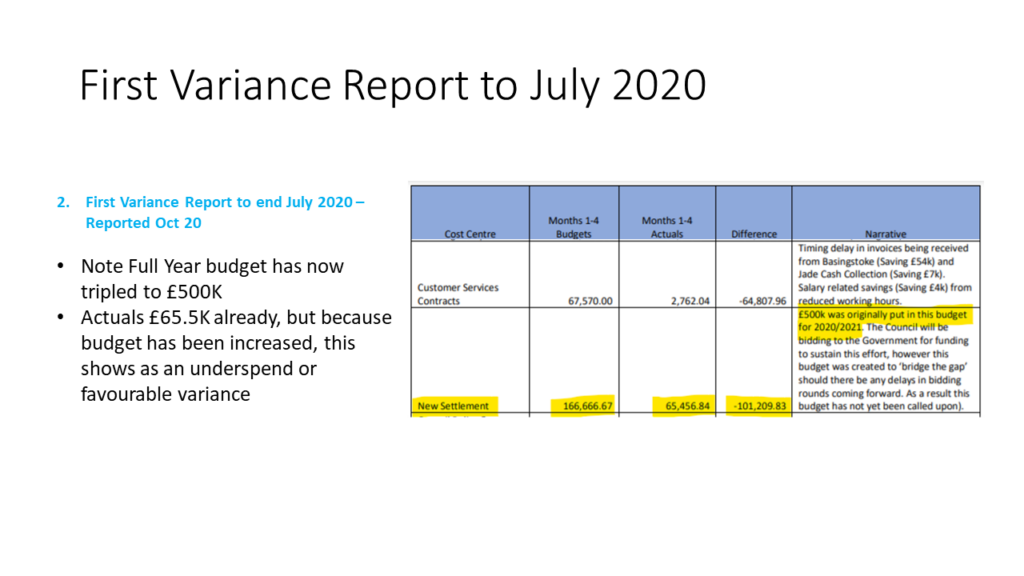

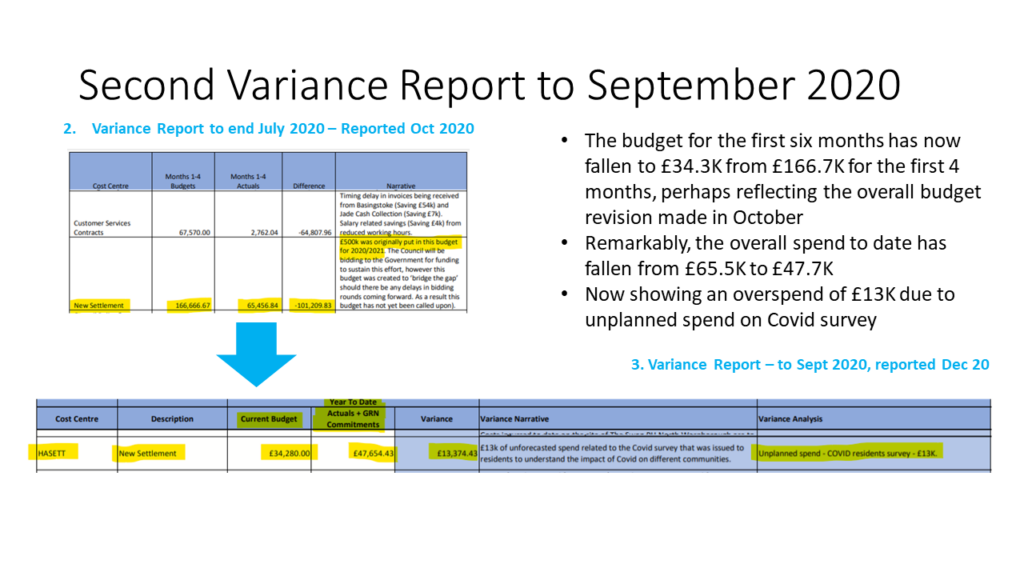

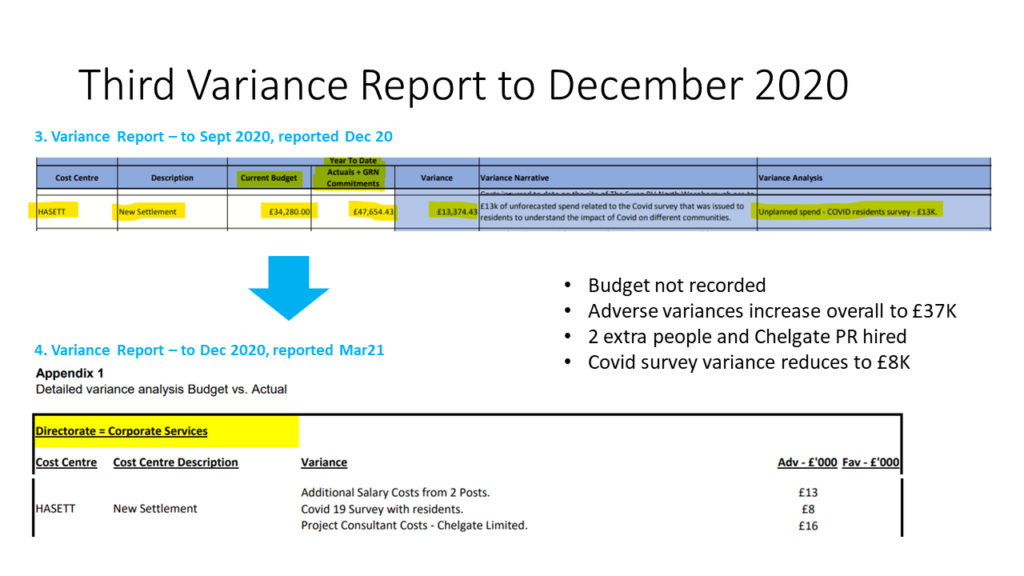

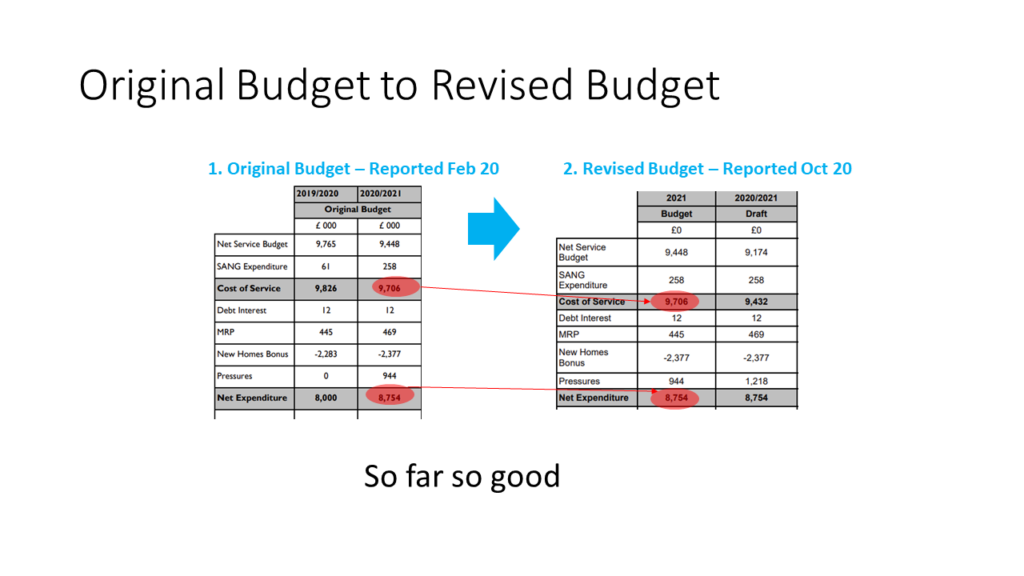

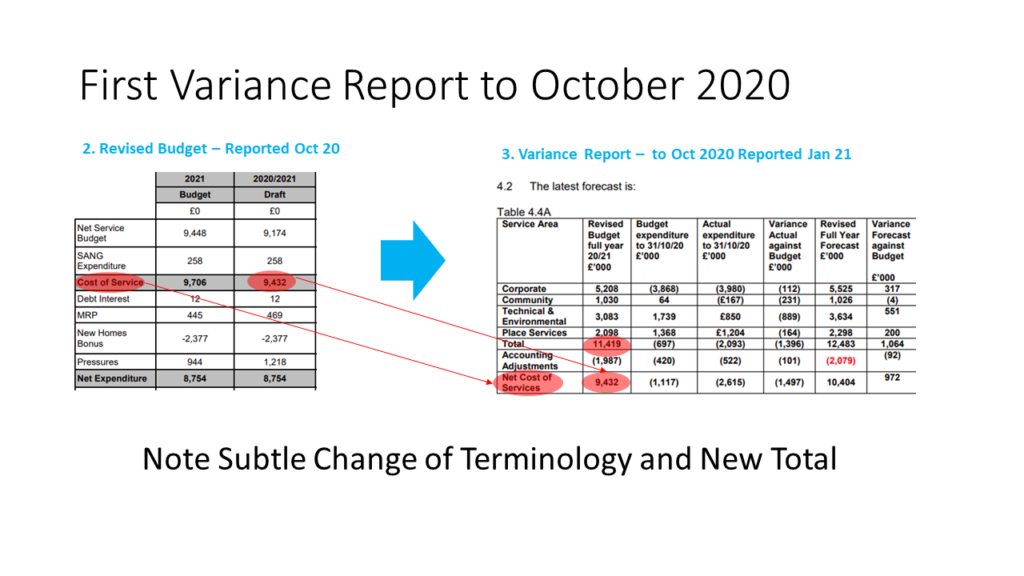

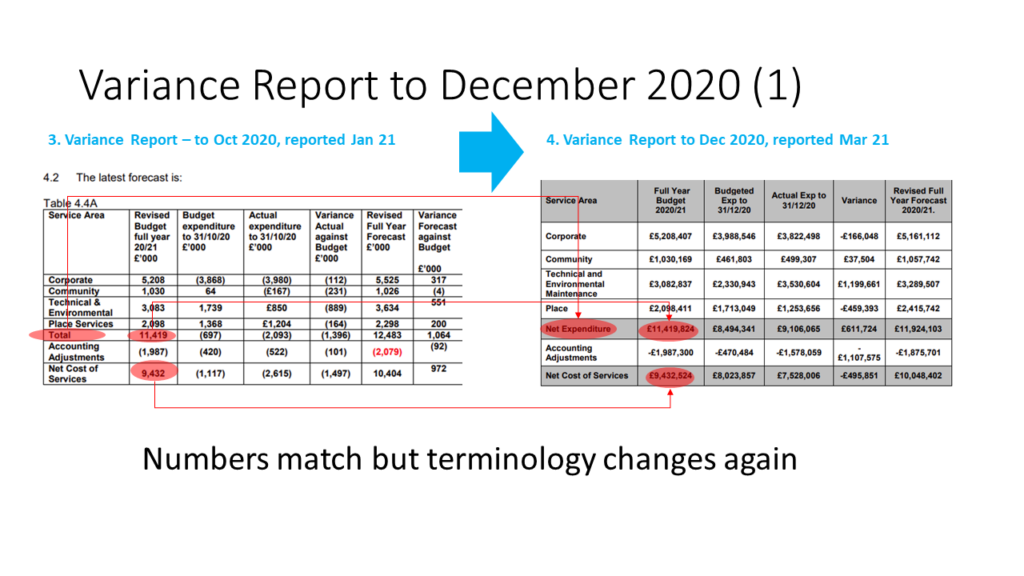

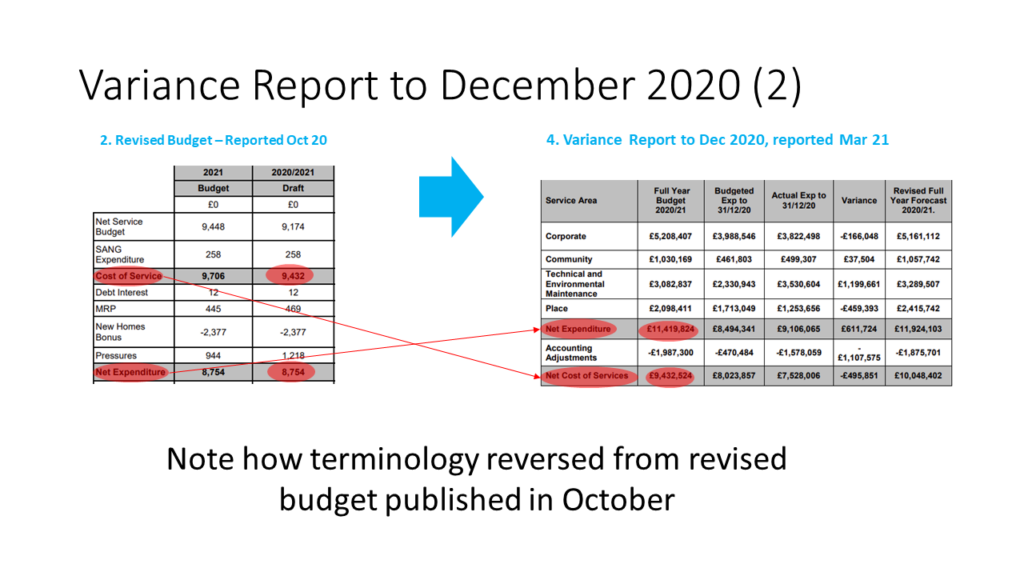

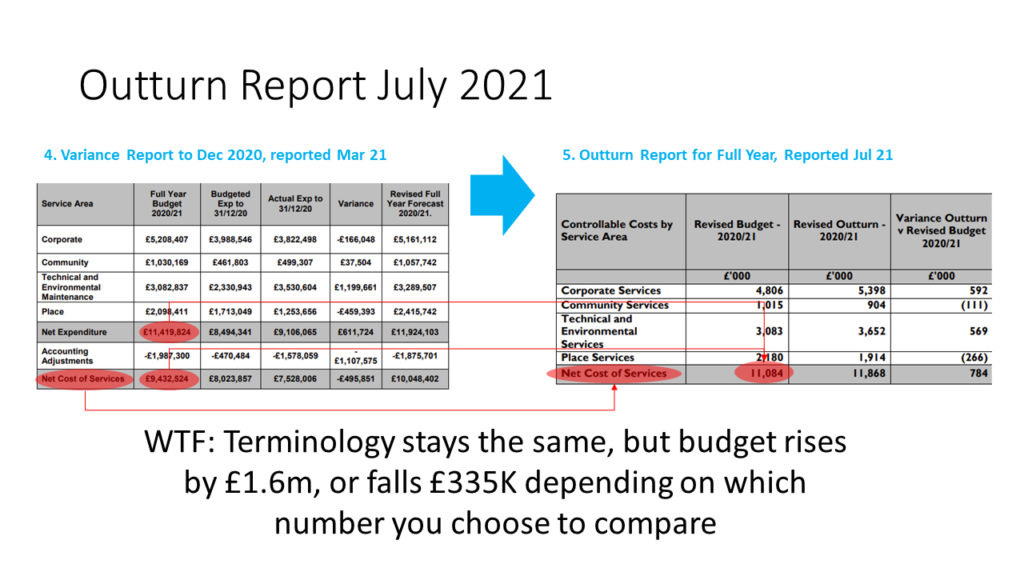

Our Response. We covered the ever changing budget and spending for Shapley Heath here. During the year, the full year budget has fluctuated from £167K originally to £500K in July. It went back down to £68.6K (2 x half-YTD £34.3K budget) in October and then to zero. Spending miraculously fell from £65.5K in July to £47.7K in October. It seems they can set a budget, change it willy-nilly and then seek approval for unbudgeted expenditure after the money has been spent. In addition, Shapley Heath is not solely funded by Government grants – see below.

Oh, and by the way, the Cabinet meeting to approve the £283K transfer from reserves took place on 1 July 2021, not 3 July. Another Golden Cowpat award for this one and the special Greensill Prize for Financial Transparency.

Q6 Supplementary: £500K Shapley Heath Reserves

Q6 Supp: How much of the £500K set aside in reserves for Shapley Heath remains unspent?

A6: Promised written answer has not yet arrived.

Our Response: Of course, if Shapley Heath really was funded by Government grants, then the answer to this question should be really simple. The whole £500K should be remaining to be spent. But so far he has claimed £167K was transferred from reserves in February 2020 and we know a further £283K has just been approved.

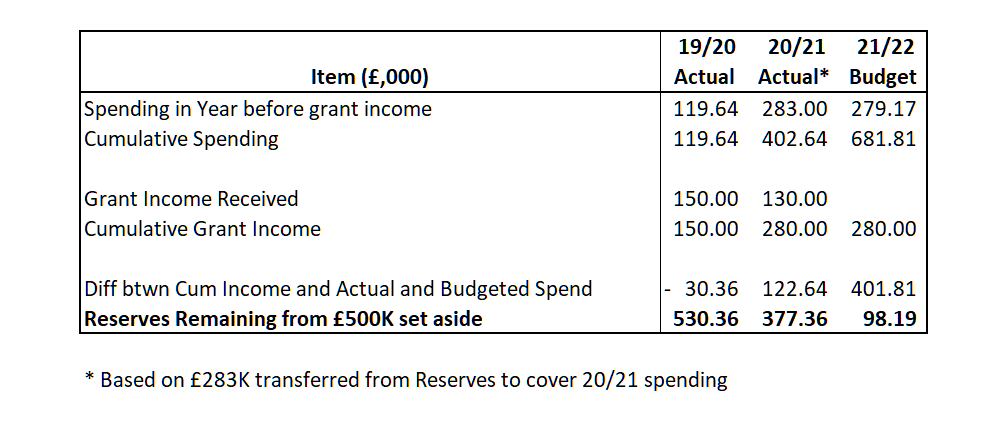

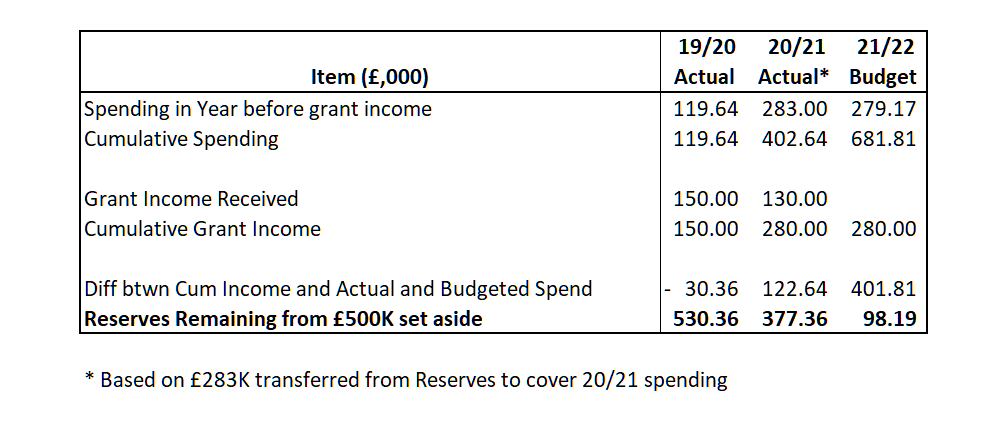

Let’s help Councillor Radley out here. By our calculations, based on Hart’s published figures, there will be ~£98K of the £500K reserves remaining at the end of this financial year. That’s assuming they don’t go over budget this year. We suspect that they will have virtually nothing to show for this spending other than a botched survey and some biased studies from developers. How much more of our money is going to be wasted on this ridiculous white elephant? We award this the Paul Daniels “Not a Lot” Prize for not even bothering to answer the question.

Shapley Heath Reserves Remaining Update

[Update] Unfortunately, we will have to rescind the Paul Daniels “Not a Lot” Prize because an answer has now been provided. The answer given was:

The answer at the 31st March 2021 is that we held £367,051, no further reserve transfers have occurred since then.

This is consistent with HDC now accounting for the £130K grant received in June 2021 in FY20/21 (within £10K). So, our estimate of ~£98K remaining at the end of FY21/22 is if anything a bit high. Table above updated accordingly. In any event, this answer shows that the answer to the main Q6 is incorrect. It is clear that some of the £500K reserve has been used. Therefore, Shapley Heath is not funded just by Government grants. [/Update]

CCH Rhetoric Awards Question 7: Shapley Heath Spending FY20/21

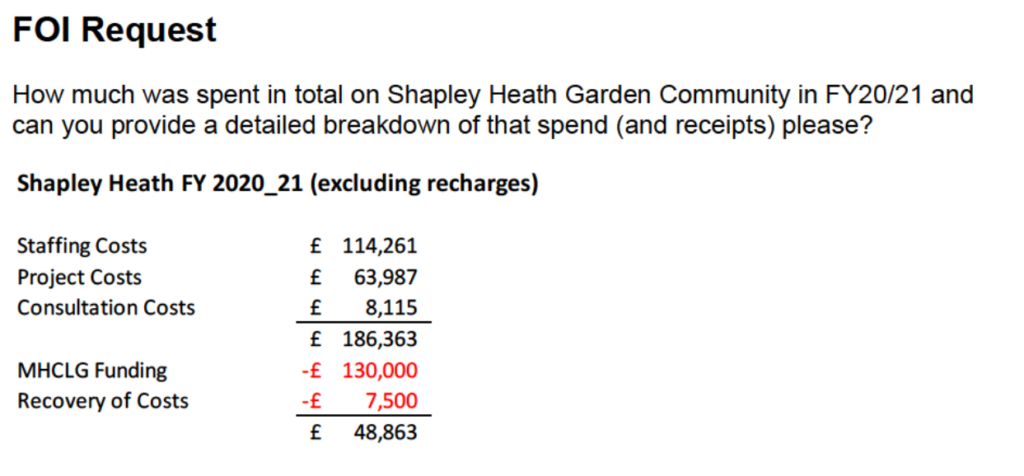

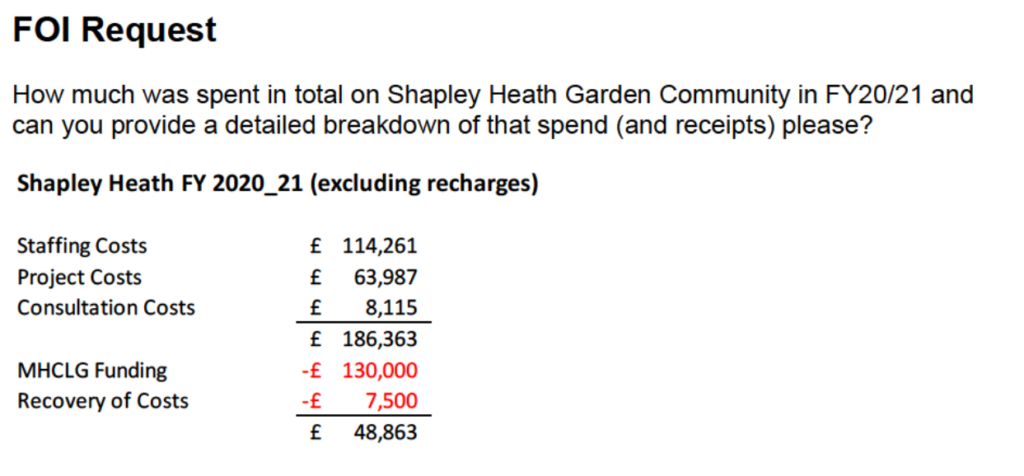

Q7: How much was spent in total on Shapley Heath Garden Community in FY20/21 and can you provide a detailed breakdown of that spend (and receipts) please?

Answer [On the Night]: As this question necessitates the provision of tables of data it will be answered as a Freedom of Information request to provide the detail. I can however tell you the totals in summary this evening by way of reading them out.

- Staff costs £114,261

- Supplies and Services of £72,102

- Total controllable costs before recharges is £186,363

- Income received for 2021 year from MHCLG was £130,000

Answer [FOI]. The FOI answer was substantially the same, with the addition of £7,500 cost recovery.

CCH Rhetoric Awards Q7 FOI Response

Our Response: We think there is some mistake here. Both responses show the £130K grant obtained from MHCLG as being accounted for in FY20/21. This is rather odd because:

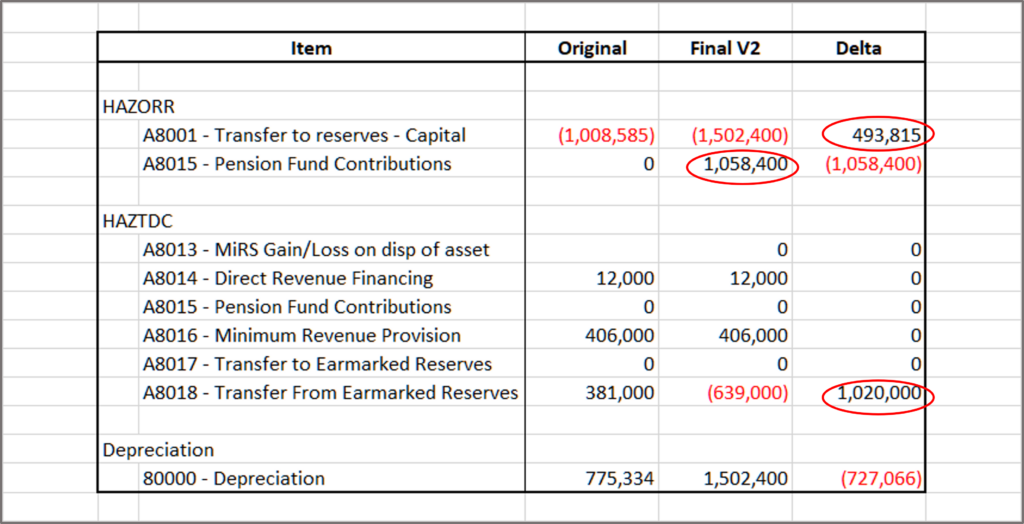

- The same £130K also shows as a line item in the Final V2 FY21/22 budget (see image below). Clearly the same money should not be accounted for in two different financial years.

- The grant was announced on 7 June 2021, and presumably received shortly afterwards. June 2021 is unambiguously part of FY21/22. No other announcement about Government funding has been made since the original grant award of £150K in 2019.

- The FY20/21 full year outturn report contained an entry showing £283K transferred from reserves to covering “FY2020/21 work on the New Settlement at Shapley Heath” (see image above). It is highly unlikely that such a large transfer would be required if £130K had been received from Government in FY20/21

HASETT – Shapley Heath Final Budget FY21-22

We give this answer the coveted Golden Cowpat along with the Enron Lifetime Achievement Award for Accounting Excellence.

Q7 Supplementary: How is it possible to overspend on employment cost budget?

Q7 Supp: From memory, the budget for employment costs was £68K and I think Cllr Radley said it was almost double that. How can we spend more than double [NB: should have said nearly double] the budget?

A7: No written answer has been forthcoming.

Our Response. My memory was right. £66.7K direct employment costs plus £1.4K for car allowances. This one gets the Lord Lucan Award for the missing answer.

[Update] We will now have to rescind the Lord Lucan award because an answer has been provided.

The budget was set in advance of the year and only included gross salary costs for 20/21 excluding on costs. When on costs were added this increased the requirement for spend.

However, we can now award a new Golden Cowpat for the answer. The £68K budget above clearly includes normal on costs of employers NI, pension contributions and even car allowances. So, the overspend is not explained at all. [/Update]