A guest post from Tristram Cary, chairman of the Rural Hart Association, setting out why we must and how we can deliver Fleet Regeneration.

40% of the population of Hart live in Fleet, and yet, in the Local Plan, Fleet is only taking only 21% of the housing development. This massive imbalance puts a huge strain on Hart’s countryside. It is extraordinary that Hart is preventing the regeneration of Fleet when you consider that:

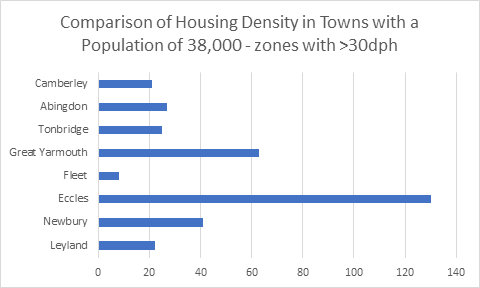

- Fleet is the most sparsely populated town of its size in Britain (see above)

- Hart admits in para 236 of the Local Plan that, without regeneration, “it is unrealistic for Fleet to try to compete” for comparison shopping with neighbouring towns such as Camberley (which is the same size as Fleet)

- The new National Planning Policy Framework (para 86) requires districts to “take a positive approach to the development of Town Centres” and to “recognise that residential development often plays an important role in ensuring the vitality of Town Centres”

Hart’s extraordinary lack of ambition for Fleet is explained by Councillor Cockarill’s statement at the 4 January Council Meeting that any serious Fleet regeneration was “a pipedream”. Hart claims that Fleet is full, and that it would not be possible to raise any serious money for its regeneration.

The Rural Hart Association (RHA) commissioned a study from Lambert Smith Hampton (LSH), a leading Town Centre regeneration specialist, to analyse the potential for Fleet regeneration. This study was submitted to Hart in response to the Reg 19 Consultation, and the full document is available on the link above. The key findings of the study are that:

- Fleet has ample opportunities for re-generation if only Hart would consider mixed-use (residential and retail) developments

- It is hopeless for Fleet to resist the residential conversion of redundant office blocks – there is no realistic prospect of these ever being revived for business use.

It’s worth reading the following summaries provided by directors of LSH.

“As has been widely reported the growth of online retail sales is having a major impact on the retail landscape – online sales are currently circa 16% of all UK sales and growing annually. There is a fundamental structural change in our shopping habits which in turn is having a major impact on retailers and town centres. The retail centres that are thriving tend to be those regional locations offering a high quality experiential mix of retail and leisure or the smaller centres that are able to provide easily accessed, convenience retail facilities in an aesthetically pleasing environment.

Interestingly, we have started to witness retail assets (shopping centres and retail parks) particularly in the South East being acquired or redeveloped for their residential potential. In some instances, we are seeing retail being proposed above shopping centres and in other instances the complete redevelopment for residential – examples include Forbury Park in Reading which has consent for 765 homes and Whitley’s Shopping Centre in Bayswater which is to be redeveloped for a mixed retail and residential scheme. This trend is likely to continue especially in areas where residential values are high and the retail assets are stagnating.

The Hart Shopping Centre could offer such potential in the future – retaining strong convenience retail facilities at ground floor level with retailers such as Waitrose but with residential accommodation on the upper parts.

What is clear, is that on a national basis we have too many shops and alternative uses, in particular residential, is a desirable way of regenerating our town centres”.

Sean Prigmore, Retail Director, Lambert Smith Hampton

And,

“I have been actively involved in the Fleet office market for more than 30 years.

The office market in Fleet has been in decline for a number of years as larger corporates have vacated to consolidate occupation in larger centers and locations benefitting from more amenity – such as Farnborough Business Park. Key Business centres such as Reading and Basingstoke have prospered whilst the smaller satellite office location such as Fleet are finding it harder to prove their relevance as office locations. M3 HQ, 70,000 sq ft on ABP, has been vacant for many years and is unlikely to be occupied as offices again. There is the potential to enable redevelopment of larger unwanted office stock for residential and to focus B1 provision in locations better served by public transport and amenity and in buildings which will allow business space for the SME sector where what demand there is lies.”

Paul Dowson , Director, Lambert Smith Hampton

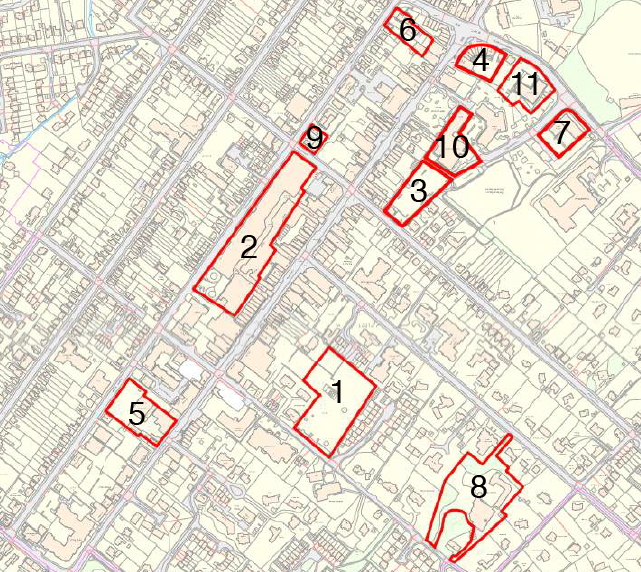

The Lambert Smith Hampton report identifies eight sites in Fleet Town centre which between them could provide 990 homes in mixed-use developments, and LSH is confident that these sites would attract developer investment. [Personally, I would add the entire civic quarter – ed]. It is shocking that Hart has turned its back on mixed use developments in Fleet without even investigating their potential. We hope that Hart Council will restructure its Local Plan to take account of the LSH report before submitting it for Inspection.

[Note that this is exactly in line with Ranil’s call for regeneration of our urban centres – ed]