There is much hand-wringing in the media today about the so-called ‘housing crisis’. We have done quite a bit of research on this topic and come across three important articles by Ian Mulheirn of Oxford Economics. His articles show we have a crisis of low interest rates, not a crisis of too few houses. We summarise his arguments here and provide links to the full articles below.

Is there really a housing crisis?

The conventional wisdom is that there is a serious housing crisis, as per the FT:

- We don’t have enough housing. The UK has an ‘endemic shortage of housing’ as housebuilding has ‘lagged behind population growth’.

- Housing costs are high as a result. These have ‘wiped out income gains made by the bottom half of households’ over the past 13 years.

- Building more will solve the problem, especially for the less well-off. ‘The fundamental problem is one of supply’ it argues, and boosting it will substantially benefit those people who are ‘just about managing’.

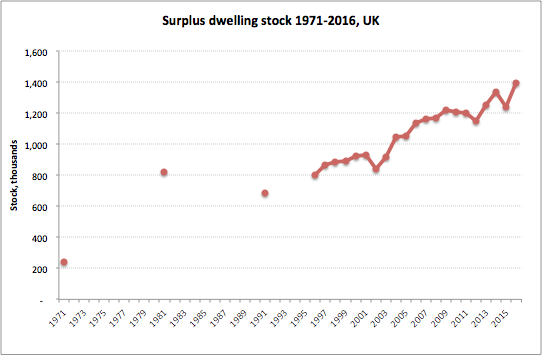

But, if you are to solve a problem, you need to unpack it and home in on the real issues. Some argue there are too few houses for people to live in, then the evidence simply doesn’t back it up. Since 1990 there were 3.0% more houses than. Latest ONS estimates show that has risen to 5.2%. Since 1971 surplus dwelling stock has risen from ~0.2m to around 1.4m.

Surplus Dwelling Stock: Source: DCLG tables 401 and 101; ONS households from 2011

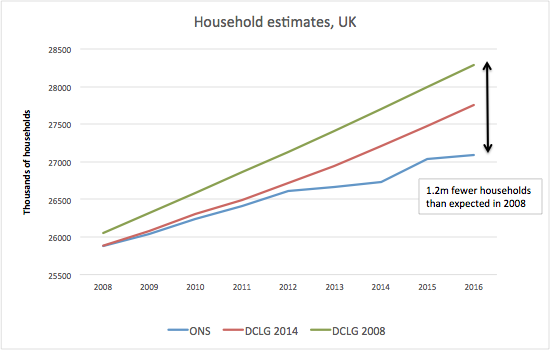

The reason for the panic is that the DCLG systematically over-estimate the number of households there are going to be:

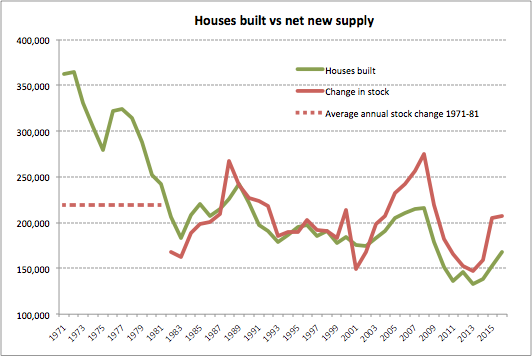

And some official numbers underestimate the number of new dwellings by only counting newly built stock and ignoring things like conversions:

This might explain why developers are not building as fast as they are being granted planning permission. If they built faster, then there wouldn’t be demand for their output.

So, if the housing crisis is not about a shortage of places for people to live, what has happened to the cost of housing?

Are housing costs too high?

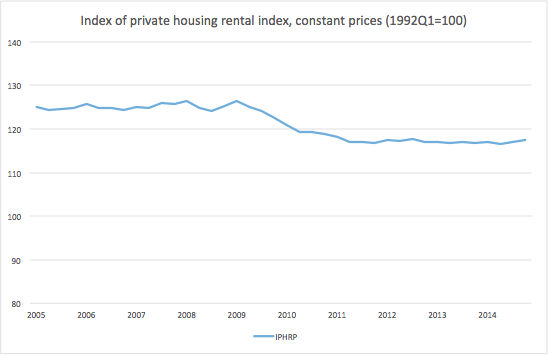

Might the housing crisis be caused by the costs of housing? Well, strange as it may seem, like for like rental costs are pretty stable in real terms:

Like for like costs of rent: Source ONS

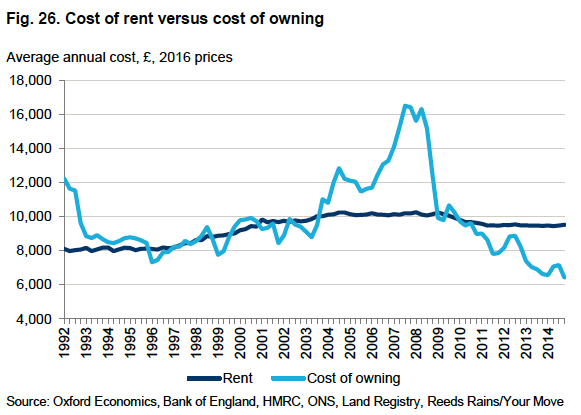

And the costs of owning are falling, compared to renting. That is if you measure the real cost of owning, which is interest costs of a mortgage plus maintenance and taxes. This doesn’t cover the repayment element of a mortgage, which is really just another savings vehicle.

So what is causing the housing crisis? There’s no shortage of housing and housing costs are not high.

Why are house prices so high and will building more bring them down?

The short answer is house prices are so high is because interest rates are so low.

What it undeniably faces, however, is very high house prices. UK house prices are now over 150% higher in real terms than they were 20 years ago. How can such an escalation of prices have occurred if there isn’t a shortage of places to live? The answer lies in the fact that housing has a dual function: it’s a place to live but it’s also an asset that pays a return in the form of the owner occupier not having to pay rent….

This means that as global interest rates fall, house prices will inevitably rise. Indeed if the real cost of ownership were to halve, we’d expect prices to double, which, as it happens, is broadly where we are vis a vis 20 years ago.

So putting it all together we have:

- no firm indication that there are too few dwellings for the number of households in the UK relative to 20 years ago;

- evidence that the cost of housing in either tenure has fallen over the past decade, and is broadly comparable with 20 years ago in real terms;

- a steady fall in mortgage, and more generally global, interest rates that we would expect to lead to a substantial price response regardless of the adequacy of the housing stock.

So, what do we do about it?

Well, there’s no easy answers, but granting permission to build more on our green fields, or even building many more houses won’t make much difference to house prices. Indeed, building too many more houses might result in big issues like they had in Spain and Ireland:

But building many more houses than people want to live in is a dangerous route to go down, as Spain and Ireland can attest. For comparison, Ireland had an estimated surplus of dwellings over households of around 14 percent on the eve of the financial crisis (which among other things proves that households don’t just form because there are vacant houses). This building mania was something like the equivalent, relative to stock, of the UK adding 1 million new dwellings per year from 2002–11. But even this didn’t do anything noticeable to rein in Ireland’s property market during the boom, with prices rising by a fair amount more than the UK’s. A similar story can be told in Spain.

Conclusion

In our view, if we want more places for young people to afford to live in, we have to build more social rented accommodation. Certainly, doubling Hart’s housing target from the 5,000 or so required by natural population change, to over 10,000 is not the answer.

Ian Mulheirn’s articles can be found on the links below:

Part 1: Is there *really* a housing shortage?

Part 2: Are housing costs high?

Part 3: Why are prices so high and will building more bring them down?